Buying property in Spain is an exciting but intimidating process. As a potential buyer, it’s important to understand the Spanish property market, the local laws and regulations, and how the purchase process works to ensure that you make a sound investment.

This guide provides an introduction to buying a house in Spain by addressing key topics such as understanding the real estate market in Spain, researching different locations, finding and engaging legal advisors, financing your purchase, tax considerations when buying in Spain and more. It also outlines some of the common pitfalls associated with purchasing a home abroad.

By reading through this guide, expats can gain knowledge about what to expect from the Spanish real estate purchasing process– from initial research stages to due diligence checks – and feel more confident in making informed decisions.

So, the aim of this guide is to provide an introduction to the process of purchasing a house in Spain, enabling expats - be they British, American, Australian or from any other country - to get the most out of their experience. Armed with this knowledge and understanding, readers can take the next steps towards becoming a proud owner of a Spanish home.

1. Homeownership in Spain

Spain has a long tradition of homeownership, with the local population having high ownership rates and foreign buyers making up an increasing part of the market. Spanish property law is based on Horizontal Property Laws, which establish different rules regarding the rights that owners have in relation to a property depending on their stake in it.

The differences between purchasing and owning a property in Spain compared to the UK are numerous, with key points including:

In Spain, all properties come under Horizontal Property Laws. This means that if you buy a flat or an apartment (rather than a detached house) you will automatically become part of the communal ownership of the building and have rights and responsibilities towards its maintenance.

A non-resident buyer in Spain may need to obtain certain permits from the local town hall, as well as obtaining the Spanish NIE number (Número de Identificación de Extranjero).

The buying process is slower and more procedural in Spain than in the UK, requiring several steps such as signing private contracts, going through administrative procedures, arranging notary appointments and registering the purchase with Land Registry. However, the process as a result contains more safeguards to protect both the buyer and the seller.

2. Is It a Good Time to Buy Property in Spain?

The Spanish climate and lifestyle continue to attract foreign investors, so it would appear that there is an undiminished demand for property in Spain. During 2022, one in every five properties bought in Spain - representing over 70,000 conveyances - was bought by a non-Spanish national.

This would suggest that investing in Spanish property is a relatively safe option, depending of course on where and what you invest in.

For British investors, it is, however, a different prospect following Brexit. The process is now more complex, with more bureaucratic hurdles put in their way. A British investor will need to have EU-citizenship, or have a partner with same, in order to avoid most of these barriers to living and/or working in Spain.

Another option would be to obtain a visa to reside in Spain. There are a number of different visa options, though non-lucrative visas, whereby you have a right to live in Spain, but not work, as well as the Golden Visa, which does award the right to work in Spain - in addition to live here, obviously - represent the most popular and effective options. Latterly, the digital nomad visa is also proving to be extremely popular.

For more information on these options, see: investing in property in Spain after Brexit.

3. Should you buy or rent property in Spain?

Buying property in Spain can be a rewarding investment. However, before you take the plunge, you might consider whether renting might better suit your needs and plans.

By renting you can get to know a local area much better before you buy, and so you can analyse and understand the local real estate market better, before you make a big investment.

For those moving to Spain from the UK, it is worth noting that renting in Spain offers tenants enhanced rights, in comparison to tenants in the UK. As a result, landlords in Spain are more likely to seek enhanced deposits and guarantees before agreeing to lease a property.

Together with increased rights are increased obligations, requiring tenants in Spain to contribute more towards repairs than would be the case in the UK. However, this is currently being studied by the Spanish government, and new rules are likely to be set-out in new legislation, due in 2023.

Of course, many do see renting as wasted money, and many decide to buy property in a Spanish area that they are already familiar with. So, if you are confident that you know the area well enough - the parts to avoid, the parts that you are aware tend to command above average prices, then buying may be a better option for you.

4. The Spanish property market and property prices

With interest rates rising around the world during the first half of 2023, and an expected credit squeeze around the corner, the financial conditions for buying property are becoming more difficult.

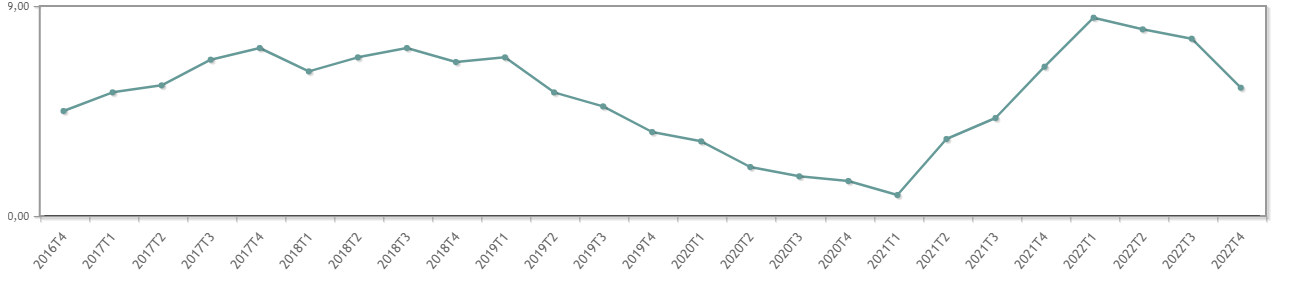

The graph below, based on figures released by the Association of Spanish Notaries, suggests that the increase in interest rates is beginning to have an effect on the variation in Spanish property prices, compared to 12 months prior.

While still over 5% higher than 12 months prior, the tendency of prices in the Spanish property market is clearly downward.

Also, it would seem that British buyers continue their love-affair with Spanish property. In the 2nd quarter of 2022, the latest figures show that the number of property purchases involving non-resident foreign buyers increased 8%, and the number involving resident foreign buyers increased 11.2% year-on-year. Foreign buyers now represent over a fifth of all those who purchase property in Spain, and British buyers had the greatest share, at 10.72%.

These figures might, of course, be interpreted differently, depending on whether you need a mortgage to complete the purchase of a property in Spain. If you don't and house price values are falling, then the market may be operating in your favour.

Of course, these are general figures, covering both new and resale property, and are nationally focused. The Spanish property market is very much a collection of different markets, and local factors trump national figures. So, while prices in the Costa del Sol may be rising, they may be falling in the Costa Blanca. Also, it can be hard to compare prices between existing properties and new-builds and off-plan projects. So, care must be taken to make a careful analysis.

If you do need a mortgage, you may wish to act with greater speed, to secure a sufficient loan to cover your requirements. On the other hand, if you are a cash buyer, you may want to see how the market evolves in the coming months. That all said, as the figures above show, Spain continues to attract property investors from around the world.

5. Viewing property in Spain and making an offer

The search for a property in Spain usually starts via the internet these days. Real estate agents always have a website, and indeed some large British real estate websites also offer a range of properties in Spain. Bear in mind when making your property search, that often the same properties are marketed via various estate agents, so you may find differences in property values.

As in other property markets, the buyer normally will contact the real estate agent with questions and request a viewing. Should you be happy to proceed, you would then make an offer. It is at this point that the process may vary from what you are used to at home.

6. The role of Real Estate Agents

Once you have made an offer, it is likely that the estate agent will ask you to sign a reservation contract. You should be extremely careful about this, and our best advice, is to contact an independent English-speaking lawyer in Spain, before you sign anything.

As mentioned in our main article about buying property in Spain:

"Even though you have paid a deposit they will not take the property off the market, nor will they remove the online ads, and of course they will not stop negotiating with other interested parties. The real reason why estate agents require this first deposit when dealing with property purchases is to see that your offer is serious, that you are not there to waste their time,"

A downside here is that, should you pay this "reservation fee", but don't proceed with the purchase of the property, it can be tricky getting the estate agents to return the fee. There is a real possibility that they will try to convince you to buy other properties on their books.

It always pays - when buying a property in Spain - to consider the motivations of the person you are dealing with. If in doubt at all, make sure to speak with an independent solicitor.

7. Deposits and 'Arras' Contracts

In Spain, as stated previously, the property purchase process can be rather more systematic than in Anglo-saxon countries. One particular aspect that is different is the arras contract. This is, in effect, a 'contract to contract'.

The benefits of this are clear - both the buyer and the seller make a commitment to exchange a specified property, for a specified amount, on or before a specified date.

Failure to comply with the terms of the contract as signed, result in the loss of deposit if the buyer is the cause and twice the amount of the deposit (in effect), if the seller is the reason that the contract is not performed.

Note that the arras contract is a formal part of the process of buying property in Spain, and should note be confused with the 'reservation agreement' mentioned in the previous paragraph.

It is also common for the deposit to be paid to the seller's account, which is a difference with how the conveyance proceeds in the UK and other countries. Agreement may be made to make payment instead to a notary's escrow account, but this would need to be agreed between the parties.

Once again, this is not an agreement that you should sign without the assistance and advice of an independent solicitor in Spain.

8. Due diligence

The point in time that due diligence is carried-out may vary, though most buyers prefer to wait until such time that they are sufficiently certain that they want to buy the property before investing in a lawyer to review the licences and overall legal situation.

Essentially, the lawyer will obtain a 'nota simple' for the property, being a copy of the property information from the land registry. The lawyer will of course be keen to ensure that the property belongs to the person who purports to be the current owner and they are therefore legally able to sell the property.

Should the name of the person selling the property not appear in the land registry deed, this would constitute a fundamental breach of the contract, under Article 1258 of the Spanish Civil Code, which 'obliges the fulfilment not only of that which is expressly agreed to, but also to all consequences, which are by their nature, a product of good faith, custom and the law'. However, while this could give rise to a claim for damages by the affected buyer, another thing would be to collect such damages, and much, much better to avoid this calamity in the first place.

Care will also be taken by the lawyer to make sure that the land is urban land with the appropriate planning permission to permit the property built on it, and that there have been no subsequent illegal additions to the property, such as swimming-pools, extension, out-buildings etc.

Finally, the lawyer will attend the signing of the deeds in the local notary office, to ensure that the paperwork is finalised appropriately, before making sure the deeds with the details of the new owner are sent to the land registry office.

9. Survey of the property

A house survey will also reveal any improprieties undertaken by the current and/or previous owners. A house survey would be recommended for properties situated in the countryside and perhaps detached properties, which tend to provide a higher number of issues than apartments, though a survey on any type of property is to be recommended for peace of mind.

Should there have been any additions to a property, an architect or surveyor will be able to check that the current state of the property conforms to the building project approved by the town hall. If not, the architect will also be able to confirm the possibility of making it conform, what would be involved, costs etc.

10. Financing Your Property Purchase

If you want to buy a house in Spain with a mortgage, given the current backdrop of increasing interest rates and tightening liquidity in the credit markets in early 2023, you would be well advised to move quickly to secure a loan.

International banks offer mortgages as well as local lenders. In either case, mortgage lenders will be keen to obtain similar background information from you, as would be the case in the UK, US and elsewhere.

A good option would be to speak with a specialist mortgage provider who will have experience making applications on behalf of non-residents (if that is your situation).

It is likely that the mortgage will be originated by a Spanish bank, who may well require you to open a bank account in Spain with them, in order to proceed with the mortgage loan. Much more information is available in our article on arranging a mortgage in Spain.

11. Registering your deed on the property register

It is worth highlighting the fact that, while this step is not obligatory, it is often said that it is a vital step to ensure that your new title to the property is protected. But what are the specific reasons that you should register your new title on the land registry in Spain? (Particularly relevant since this entails a land registration fee!)

Legal Certainty in the future: When you try to sell the property in the future, the buyer will want to be able to verify your ownership of the property, meaning you will have to do so at a later date, leading to...

Avoiding excessive fees: If you don't register the title at the time of purchase, the fee increases when you seek to do so at a later date (up to twice as expensive), which could cause delays in selling the property, putting the sale at risk, since the buyer will not be able to...

Check for debts and liens: a vital step when buying a property is to make sure there are no liens on the property, or outstanding debts such as mortgage payments, seizure claims etc, none of which matters if you couldn't buy the property in the first place, since registration of a title in the land registry office is a necessary requirement before...

Obtaining a mortgage: For a mortgage to be legally enforceable, the Mortgage provider will need to register their interest on the Spanish land registry. If you needed a mortgage to buy the property, you will have to register the property with the property register.

12. Taxes and Other Costs when Buying Spanish Property

Where to start? It is true that in Spain, you pay taxes, and many. Given the value of property, the government derives a lot of income and of course, properties can't move, so the corresponding taxes are a guaranteed source of future income, in the form of taxes.

The first tax you will come across is the property transfer tax (ITP) - as low as 6.5% of the purchase price in the Canary Islands, and up to 11-13% in Barcelona/Mallorca. Existing properties attract ITP, while new build properties attract VAT (IVA in Spain). This is 10% except in most of Spain (the Canary Islands excepted).

Since the deeds are normally signed in a notary office, you will have to manage the notary costs, and of course legal fees if instructing a solicitor. If you have bought the property with a mortgage loan, you must factor in also the costs of arranging the loan. Estate agent fees are normally paid by the seller, though of course this comes ultimately from the funds raised by selling the property.

Once the deeds are signed, you will want to register your new title to the property in the registry office, giving rise to a title deed tax.

Now that you are a property owner in Spain, you will pay the IBI (Council Tax or municipal tax is nearest equivalent in other countries). Also, as many foreign buyers choose to buy a property in Spain that is located in an apartment complex or urbanisation, you will have community fees to pay. These are paid in proportion to the space owned by each property owner in the urbanisation or building.

Note that, when buying a property in Spain, the lawyer will seek to obtain a letter from the Community of Owners to confirm that there are no outstanding debts to the Community by the previous owner.

Finally, and to be complete, the property will eventually either be sold or passed on to beneficiaries of the property owner's estate. Therefore, eventually, the property owners or their heirs may have to deal with capital gains tax and/or Spanish inheritance tax. We provide more complete information in our guides on property taxes in Spain and costs of buying property in Spain.

13. Power of Attorney

Should you wish to buy a particular property, but aren’t staying in Spain long enough to complete the purchase personally, it is always possible to draft a ‘special’ power of attorney, that includes the power to purchase a property and administer estates, in favour of your lawyer, that will permit your lawyer to complete the purchase on your behalf.

With such a power of attorney, your lawyer can manage the purchase of the property in your name without the need for you to be physically present.

After creating the power of attorney, your lawyer will ensure that they have all the relevant details necessary to properly act on your behalf, such as the specific property you wish to purchase as well as the purchase price.

14. Buying land to build a new property in Spain

The main concern when buying land in Spain - as opposed to a property - is to ensure that the land has urban planning permission i.e. that you can build that which you intend to construct on the land.

This process needs to be overseen by a qualified architect who will be able to advise on the type of planning permission that has been approved for the land, and whether you can build what you want.

It may be that the architect will inform you that changes would need to be made to your project, but that otherwise you can proceed.

It almost goes without saying that you should never buy land without the advice of a lawyer - to determine the overall legal position - and an architect to delve into the specifics.

15. Rural Property in Spain

When searching for properties abroad, it is quite often the case that the prospective buyers are seeking an isolated area, often surrounded by beautiful scenery. While the purchase price of buying a house in Spain can be lower in rural areas, there are other considerations to take into account.

If you are buying land in Spain that is legally classified as ‘rústico’ you have to be aware that you will be buying a legally-protected plot as a result of a particular reason (environmental, historical, touristic, heritage value, etc.) such that it may be used solely in accordance with its nature and specific purposes. Rustic land is known as being highly-protected against urban development. Its common use is connected with agriculture and livestock, horticulture, or traditional elements (windmills, water-sources, etc.).

It is also possible that the property of your choice is classified as ‘rural’. Despite being located in similar areas as the rústico land, rural areas are mainly conceived for residential purposes and, therefore, development is not as restricted as in rústico areas, being focused on fulfilling its population needs according to the local objectives.

However, often a house in Spain located on land that has been declared to be rural, are properties that are not inscribed in the land registry, or are in such poor condition that their refurbishment is essential to obtain a certificate of occupancy.

An important question therefore arises: how should a prospective investor approach such properties?

The first step will be to speak with a lawyer who can provide you with professional advice on the legal status of the property. The lawyer will obtain a report from an architect which will specify whether, according to local by-laws and planning regulations, there is any real possibility that the Town Hall will concede a works licence to permit the rebuilding of the property (in case this is needed).

16. Rehabilitation Licence

In the normal course of events, if there is already a property built on the land in question, even if it has to be completely refurbished, the Town Hall typically will grant a licence to the new owner to “rehabilitate” the property, always taking into account that there are certain rules that have to be followed, such as, for example, not building more than one or two floors high, or related to the maximum square metres that the property can have.

What is certainly not advisable is to buy a land in a rural area where there’s never been any property located. This is because Town Halls base their decisions to grant (or not to grant) planning permission on the fact that there is an existing property located on the land that the investor wishes to buy.

So, once a favourable report with respect to the property is obtained from the architect, it is then safe to buy the rural property (bearing in mind that unfortunately no-one can 100% guarantee that the Town Hall will issue a licence to refurbish the property).

At the same time as carrying-out the purchase, and in a simultaneous operation before a Notary Public, we can, with the report of the architect, make a New Build Declaration (declaración de obra nueva), so the Notary would write in the deeds that on the land there is a house, and then would send it to the property registry so that the house may be legally registered.

Once acquired, the new owners may initiate steps for reform.

17. Buying a Farm in Spain

In general, buying a farm in Spain is a more complex process than buying rural property since, in addition to the usual due diligence required to buy a rural property, other legal matters have to be considered.

Such legal considerations will vary according to the kind of livestock included in the sale: pigs, chickens, calves, sheep, hens, turkeys, ducks, cows or housing milk goats, among others. Similar to many who are starting a business in Spain, in order to be able to open an industrial farm, you are required to have certain permits.

The most important one is registration in the Exploitation Registry of the Autonomous Community where the farm is located; this registration is identified by a registry number.

It is essential that the farm you wish to purchase has this registry number as, otherwise, you will not be purchasing a working farm but rather simply buying a regular property, albeit with animals that cannot be used to produce any livestock product.

The holder of the livestock farm has to complete some courses to be allowed to apply and use the necessary products to disinfect the stalls where the animals are kept.

Also, it is always necessary to count on a professional to manage the solid and liquid wastes produced by such animals. Wastes are very important in farming, as there are many ways to ruin the soils and waters. Farming, ultimately, is a responsibility.

As regards the administrative arrangements, it is compulsory to register as self-employed by choosing the appropriate tax classification in the Spanish Tax Office (Hacienda), plus VAT and IRPF (Personal Income Tax).

18. Buying a Bar in Spain

Another popular option for foreign citizens relocating to Spain is to buy a bar. Buying a bar can become a complex endeavour that requires you to create a checklist to ensure that a number of important issues are dealt with, before - frankly - giving away any money to get a supposed right in the bar you are interested in taking over.

Yes, it is common practice that the seller will ask you for money to be paid beforehand as a kind of deposit in order that you would 'supposedly' get the reservation and first choice to get the bar; please take extreme care - this is money hard to get back if you later discover any unexpected issues on the way to finally get the business. For example:

- Did you know that you may be held liable for wages arrears of the employees of the current owner? Maybe you want the bar, but not the staff!

- Are you sure the person who is offering you the business has the right to pass it on to you at all? Maybe he is a tenant, maybe he even owes some rent, and maybe he has not got the right to sell-on the contract to run the bar, so you are paying a person who is just hoping to get your money and then leave

- You have seen the business running, but this doesn’t mean that the bar has an appropriate licence for that live music show or to play bingo, or just to make the refurbishment you were planning?

- Very likely the restroom is not adequate for disabled people and so you’ve got an obsolete licence, which will bring you problems if a neighbour is not happy with you and makes a formal complaint to the authorities.

- Many bars have covered parts of the external area of the bar to hold more customers, that in fact ought to be open to the public to walk through.

- The tables and chairs on the terraces might require the payment of fees to the Town Hall or an additional rent to the building, or they may be even totally illegal (ocupación de vía pública)...

So, the best advice is that to be extremely cautious when considering the purchase of a bar in Spain and make sure to get independent legal advice before paying anything -better to be sure everything is in order than risk your savings, a lot of energy and your aspirations on someone you don't know, telling you that “everything is in order”.

19. Setting Up Utilities

While often a pain in any country, dealing with utility companies in Spain is extra complicated due to the fact that a) you possibly don't speak the language, and b) the process will be different, requiring different types of documentation.

Typically a lawyer will include in the conveyancing service an option to arrange for the transfer of the utilities from the name of the previous owner into your name. If not, ask the lawyer about this, since it will save a lot of hassle.

20. Buying Property with a Sitting-tenant

In Spain, the legislation that regulates leases is the Law of Urban Leasing: Ley 29/1994 - Ley de Arrendamientos Urbanos (LAU).

This law establishes that the duration of a lease shall be that period which the two parties to the lease have freely agreed, renewable annually for a minimum of up to three years. To this rule there are two exceptions:

- Where the tenant decides not to renew the lease, with an obligation to inform the landlord of an intention to quit the lease with at least the minimum notice period of 30 days before the end of the contact term or one of the renewal periods. If the tenant wishes to terminate the lease earlier, this needs to be carried-out in compliance with the terms of the lease for such contingencies, with the possibility that the landlord may be entitled to compensation for lost rental payments under the lease.

- The second exception arises where, at the end of the first year of the lease, the landlord expresses the need to obtain vacant possession of the property in order that they themselves, their children or spouse can live there. In this case, a notice period of two months is required.

Where the landlord is selling Spanish property that is rented out, in the first place, it is necessary to inform the buyer of the fact that the property is subject to a lease. If the buyer wishes to proceed, notwithstanding the fact that the property is rented to a tenant, the conveyance of the property may proceed as it would otherwise.

In this case, the buyer assumes the role of landlord previously held by the seller (this change is required to be communicated to the tenant) and therefore find themselves in the same legal position with regard to the tenant as the previous landlord.

If the buyer does not wish to buy the property because it is subject to a lease, should it be the case that only a short period of time remains before the lease can be legally terminated, it may be convenient to wait and notify the tenant that you do not wish to renew the lease. If this is not the case, then the only remaining option would be to negotiate with the tenant, given that they are entitled by law to reside in the property for the lease period, renewable up to three years.

A different situation entirely arises where the tenant fails to pay the rent or defaults on other obligations established in the lease, whereby the landlord must initiate eviction proceedings as well as an additional claim for outstanding rent.

It is important to bear in mind that the tenant, once informed of the intention of the landlord to sell the property, has a right of first refusal to acquire the property on the same terms as offered, though this right may be expressly waived by the tenant if the terms of the lease so include it.

21. Property lawyers in Spain for buying a house in spain

While property conveyances in Spain are managed at a local notary office, it is worth pointing out that the notary's legal obligation lie to both parties, not the buyer specifically. It may well be that the notary does not speak English - especially in more rural parts of Spain.

Therefore, instructing an independent lawyer who is registered with the local bar association, is vital to ensure that you are advised independently and avoid any of the many pitfalls of buying property in Spain. Caveat emptor!

22. Selling a property in Spain

Once you have become a property owner in Spain, no doubt you hope to enjoy the lifestyle for many years to come. However, circumstances change and eventually the property will need to be sold.

There are a number of tax issues that need to be taken seriously, for example, capital gains tax in Spain. This can be mitigated or reduced for a number of reasons, and it is worth speaking with an accountant in Spain, or tax lawyer, who can advise you on your tax liability.

It is also worth noting, at the time of buying a property in Spain, if you are moving to live permanently in Spain, that you could have a capital gains tax liability arise from the sale of a property outside Spain. This is a result of the fact that once a tax resident in Spain, you are taxed on your global income, and this could result in a very high capital gains tax bill.