In this article, you will discover how the Spanish inheritance tax system works, including the legal background, who is liable to pay tax, which assets attract inheritance tax, how much inheritance tax is payable, which allowances you can claim and the process step-by-step for paying inheritance tax.

1. Spanish Inheritance Law - non-resident or resident?

If a person was resident in Spain at the time of their death, then absent evidence to the contrary, Spanish law applies to the inheritance of their estate. Why is this important?

The application of Spanish law when someone dies can be critical because, under Succession law in Spain, all of the deceased's legal assets will not automatically be inherited, as may be presumed under British law, by the surviving spouse.

Instead, the deceased's assets are distributed under the Spanish system of forced heirship rules which ensures that children of the deceased must receive a proportion of the estate.

Determining Spanish residency can sometimes be a tricky question, though it is worth noting that many British citizens buying property after Brexit have done so in order to obtain a Golden visa which, in itself, may be evidence of their Spanish residency.

For those who were able to live in Spain without a visa, residency in Spain can be inferred if the person spent more than 183 days a year there. Where their primary source of income is located can also be relevant in determining residency/taxation status.

2. Avoid the application of Spanish inheritance law

Even if you are resident in Spain, as long as you create a valid last Will & Testament that specifies your desire for the law of your country of origin to apply, then Spanish law will not apply.

That said, many married couples that are resident in Spain are not aware that in their future inheritance, Spanish law will be applied due to the fact that they are technically resident in Spain.

So, when creating Spanish Wills, the first thing the couple should do is to declare that the inheritance law to be applied is that of your own country – which usually will provide much more freedom and control than the Spanish legal heirs rules.

Secondly, you can determine your exact wishes for the transfer of your assets following the regulations of your national law. You can also choose if you want your Spanish Last Will & Testament to only apply to your Spanish assets or to your assets in all countries.

Of course, if the deceased did not have residency in Spain, then Spanish law should not apply to the inheritance of any assets located in Spain.

Now that we have covered the legal basis, we can move on to how Spanish inheritance tax works.

3. Spanish Inheritance tax rules - who pays inheritance tax?

So, first things first - who is liable to pay Spanish inheritance tax?

It is a common assumption by those who are not Spanish resident that they are therefore exempt from. This would be a mistake, since there are a number of examples of where non-residents are subject to Spanish taxes, for example wealth tax in Spain.

According to Spanish inheritance law, a deceased individual does not need to have had residency in Spain at the time of their death in order for their estate to be subject to Spanish inheritance tax. It is sufficient for them to have owned physical assets in Spain - such as a property - in order to be liable to pay inheritance tax here.

The important point to appreciate here is that, assets located in Spain belonging to a deceased person attracts Spanish inheritance tax, whether the deceased was tax resident or not. As a result, non-residents should not assume that they are exempt.

If the deceased was a tax resident in Spain, their worldwide assets would be subject to tax in Spain - including Spanish inheritance tax. This would apply to all their assets and investments, wherever they are located..

Note that as most couples will have jointly owned property in Spain, then the proportion of the property owned by the deceased spouse will be subject to Spanish inheritance tax. However, there may be high tax exemptions available under regional inheritance tax rules if it is the family home.

4. Assets subject to Spanish Inheritance Tax

According, Inheritance tax in Spain is payable on all bequests of assets, including:

- Property

- Vehicles

- Cash

- shares

- bonds

- any cash paid out by the maturity of a life insurance policy

5. Factors that determine your Spanish inheritance tax lability

The major difference between Spanish inheritance tax and the UK is that in Spain the tax payable is determined with reference to the heir or beneficiary rather than merely considering the size of the estate itself.

Whereas in the UK inheritance tax is only payable where the threshold (currently £325,000) is exceeded and there is no need to consider any other factor if the estate is valued below this, the same is not true in Spain.

In Spain, it is necessary to consider the following factors before the inheritance tax liability might be determined:

- Allowable expenses e.g. funeral costs, medical care, mortgages on assets etc

- How closely related the beneficiary is to the deceased: Groups

- Inheritance Tax Allowances

- Inheritance Tax Rates

- Pre-existing Wealth of the Beneficiary

6. Allowable Expenses that reduce Succession tax

The amount payable is the net amount after deductible costs and expenses. Admissible expenses would include:

- Social Security Debts

- Tax Debts

- Outstanding Mortgage in Spain

- Final Health Care Expenses

- Funeral Costs

Not included would be debts owed to any of the beneficiaries even though they chose to turn down the bequest.

Note that there are a number of ways that you can reduce your inheritance tax liability, though these are best set-up in advance ie by employing estate planning in Spain.

7. How closely related is the beneficiary? Group Definitions

For the purposes of determining the proximity of a relationship to the deceased, the legislation dealing with Gift and Inheritance Tax in Spain (Ley 29/1987) considers there to be four categories or groups:

- Group I – Children, including adopted children, under the age of 21

- Group II – All other children, spouses and parents

- Group III – close relatives such as brothers and sisters, grandparents, aunts and uncles

- Group IV – more distant relatives

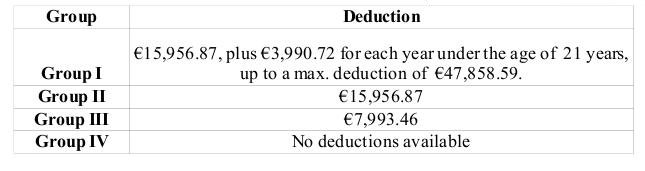

We then must apply the allowances permissible according to the Group that the beneficiary is a member of. This may vary depending on whether national government rules or regional rules are applied to the inheritance. For example, under national goverment rules:

Example What inheritance tax allowance would a 16-year old child receive on a bequest from a parent, under the Spanish State law rules?

A 16-year-old child who inherits from her parents falls into Group I her situation falls into Group I and so she may claim an allowance of €15,956.87 + (€3,990.72 * 5 = €19,953.60) to give a total allowance of €35,910.47.

8. Inheritance Tax Allowances for Non-Residents

Similar to the UK, where the inheritance process differs according to the region of the UK that the deceased was resident, Spain has a devolved system of inheritance laws. This gives the different regions of Spain the ability to apply different allowances or deductions for different groups of taxpayers.

Formerly, only those who have been ordinarily resident in a particular region of Spain over the balance of a period of five years prior to their death will have the more generous regional inheritance tax exemptions applied to their estate. In addition it required the beneficiary to be resident in some part of Spain. If not, the national rules applied.

What this meant of course was that, more often than not, the rules for most non-Spanish beneficiaries were calculated using the less generous 'national level' deductions.

However, following a judgment by the European Court, the Spanish government has passed into law Ley 26/2014 about inheritance tax rates in Spain, which came into force on January 1st, 2015.

The new legislation provides that European Union citizens, ordinarily resident in another European country, may apply any deductions available to residents of the region in Spain in which the assets of the inherited estate are located.

This was further extended by the Spanish Supreme Court in a ruling in 2019, which extended the ability to benefit from more generous regional allowances to not just EU residents, but non-EU residents also.

This is particularly good news to British citizens following Brexit, since beneficiaries of estates in Spain can now apply much better allowances.

9. Regional Deductions: Spanish Inheritance taxes by region

The inheritance tax allowances available in the autonomous regions of Spain tend to me more generous than the state level deductions. For example, there are often almost 100% deductions available to spouses and children, relating to the primary family home and businesses.

Below are links to information on applicable tax deductions that may be applied to an inheritance, per region in Spain:

Alicante Andalucia Balearics Canaries Cataluña Galicia Madrid Murcia Valencia

New inheritance laws in Spain have ensured that even non-EU citizens can benefit from the more generous regional tax allowances.

10. Disabilities

In addition to the above allowances based on the closeness of the relation between the beneficiary and the deceased, should any beneficiary be disabled, further exemptions ranging between €47,858.59 and €150,253.03 are available.

11. Life Insurance Policies

If the deceased took out a life insurance policy in favour of a beneficiary there is an exemption up to the value of €9,159.49 where the beneficiary is a spouse, child or parent.

12. Spanish Inheritance Tax and The Family Home

With so many people buying real estate in Spain, it is useful to note that an exemption also exists for tax payable on the permanent or habitual residence. This exemption applies equally to spouses, children and parents of the deceased at a rate of 95% of the value of their inherited portion of the property up to a maximum value of €122,606.47 each.

An important proviso exists in that the property may not be sold for a period of 10 years after the inheritance. Other relatives, further removed, may also benefit from this exemption, but must have been living with the deceased in the property for a period of at least two years prior to the date of death.

13. Spanish inheritance tax rates

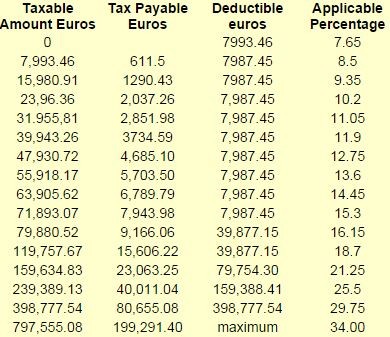

Inheritance tax is a progressive tax in that the tax rate to apply increases as the amount inherited increases according to the scale published by each autonomous community in Spain or, if such a scale is not published, then according to the scale published by the central government.

Obviously regard must be had to where the assets are located to determine which scale is applicable but the following table of the scale published by the central government serves as an example as to how the tax rates function.

14. Spanish inheritance tax Calculator

To demonstrate how the tax rates are applied, consider the following example:

Where three children, once allowances and expenses are deducted, each inherit assets valued at €45,000 from a parent, to determine the amount of tax payable by each we would calculate as follows:

Up to €39,943.26 the tax payable is €3,734.59

The portion above €39,943.26 (€45,000 – €39,943.26 = €5,056.74) is taxable at 11.9% = €601.75

So, total tax payable by each child is € 3734.59 + € 601.75 = €4,336.34

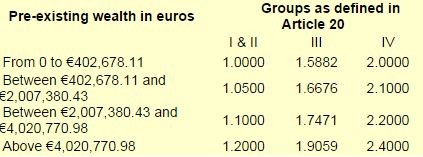

15. Pre-existing Wealth of the Beneficiary

Inheritance tax in Spain takes into account the existing wealth of the beneficiary when determining the amount of inheritance tax they are liable to pay. This may vary per region of Spain, however below is the most typically applied table of wealth coefficients:

How the pre-existing wealth coefficients work: For example. a brother of the deceased inherits an estate comprised of cash of approximately €68,000 generating a net tax liability of €6,000 (after allowances and deductible charges been deducted and the appropriate tax rate applied). The beneficiary has a pre-existing wealth of €450,000.

Then the total tax payable increases to 6,000 x 1.6676 = €10,002 (As a brother of the deceased the correct relation category is Group III).

16. Taking out Probate in Spain - the Inheritance Process

Taking out probate in Spain tends to be more straightforward than in some other countries - however, this is only the case when you have all of the documentation in place.

The Spanish probate process is set-out below, and as you will see, it is assumed you have taken anticipatory steps to ensure all documentation is in place. Needless to say, this does not apply to everyone.

17. Death Certificate

The first thing that needs to be carried-out is to obtain the Death Certificate (Certificado de Defunción ).

If death occurred in Spain then this can be obtained from the Civil Registry (Registro Civil) where the death occurred. The address of the local Registro Civil can be found by going to: Registro Civil.

If the testator died outside Spain then a death certificate must be obtained from the relevant authority in that state. For example, if the testator died in England or Wales, information on obtaining a death certificate can be requested by clicking on the following links:

England and Wales Northern Ireland Scotland Republic of Ireland

Please note that if the Death Certificate is not written in Spanish then it must be translated and legalised i.e have the Apostille stamp attached. It can then be used as an equivalent to the Spanish 'Certificado de Defunción'.

18. RGAUV Certificate

With the Certificado de Defunción or legalised Death Certificate arranged then the next step is to request the Certificado de Registro General de Actos de Última Voluntad (RGAUV).

The RGAUV certificate is issued by the central office for Wills and Testaments in Madrid and verifies the existence or otherwise of a Spanish Will.

You need to wait for a period of 15 days from the date when death occurred before ordering the certificate. If ordering the certificate then there is an administrative charge that requires completing form 790.

You must send an original (not a copy) of the death certificate and it normally takes around 10 days to receive the certificate.

19. Life Insurance

It may also be convenient at this stage to acquire any Life Insurance Contract that may exist. If the life insurance contract was taken out in Spain then it will be registered in the same place as the RGAUV certificate.

If however, as is more likely, the life insurance was taken out in a country of origin such as the UK or Ireland then the insurance company will have their own process. This will typically involve sending an original (not a copy) of the death certificate and completing whatever form the insurance company uses.

20. Certified Copy of the Will

Having the first two certificates on the list allows us to get a Certified copy of the Will from the notary in Spain where the Will was signed. This must be an authorised copy and not the simple copy that a testator would typically take away after signing the will at the notary's office.

The RGAUV certificate will identify the most recent and therefore legitimate Will as well as the notary office in which the Will was signed. It is in this notary office that the will is kept and where an authorised copy can be obtained by presenting the Death Certificate and RGAUV certificate. The cost is determined by the age and the number of pages in the Will.

The persons who are permitted to request this copy are those named in the will as beneficiaries or as executors of the Will.

21. What if no Will was drafted?

If there is no valid Will that states that the testator wishes to apply the rules of their country of origin, and the testator was ordinarily resident in Spain at the time of death, the the rules of intestacy of Spain will apply.

If such rules do not apply, for instance because the testator was ordinarily resident in the UK, then the rules of intestacy local to their place of residence in the UK will apply.

In the UK, for example, it is typical, in the absence of a last will and testament, for a close relative to swear an oath and obtain 'Letters of Administration' which confer the right to deal with any assets in the name of the deceased, in accordance with the laws of intestacy.

Matters become complicated in Spain as a result of the local notary and land registrar sometimes insisting on Spanish documents, impossible to obtain from the UK.

Ultimately, some notaries will accept the Letters of Administration, duly legalised and translated by a sworn translator. Others will require a certificate of law from a legal source in the UK (such as a notary or a solicitor) which states the applicable line of succession according to the rules of intestacy of that region of the UK.

22. Property and Other Assets

An inventory should be carried-out to determine the final assets of the deceased.

In order to identify that the property that the deceased lived in was owned by them, you can check the local Land Registry and request a 'nota simple' which will detail the deceased as the current owner. This can now be done online by going to: Nota Simple.

Should the deceased have had bank accounts or share-holdings then it is necessary to request a certificate of the value of these on the date of death of the deceased by presenting the death and RGAUV certificates.

Please note that once these certificates have been obtained no money may be withdrawn from the account as it will be frozen until it has been legally transferred to the beneficiary.

23. Assets and Liabilities

On the basis of the inventory previously carried-out, a 'manifestación de herencia' is drawn-up which is a list of the assets and their valuations as well as any debts and obligations.

A 'cuaderno particional' is then drafted which, following the provisions of the Will, stipulates how the assets are to be distributed and any debts satisfied.

In certain cases this document may be drawn-up privately, for example where there is only one sole heir or where the asset to be inherited is a property which is not to be divided for the time being. Otherwise, the document must be drawn-up publicly in the presence of a notary.

24. Debts and Rejecting an Inheritance

Should the deceased have accumulated debts then these become the responsibility of the beneficiaries. This liability extends to the personal assets of the beneficiary should the proceeds of the inheritance not be sufficient to cover them.

As a result, this can be a very important aspect of inheritance to consider if inheriting a property that is in significant negative-equity.

The benefit of inheriting will need to be balanced against the liabilities to decide whether it is worth accepting an inheritance. Such acceptance can be implied by the behaviour of the heirs and so it is advisable to formally reject the inheritance via your lawyer, if advised to do so.

25. Delaying Inheritance Tax

A common situation that arises is that the beneficiaries are unable to manage payment before the legal deadline of six months from the date of death of the testator.

This is often due to the fact that the inheritance relates to a property or some other asset that is difficult to convert into cash quickly. And, of course, the property cannot be sold with good title until the taxes have been paid and the title of the property changed in the name of the beneficiaries.

It is a classic Catch 22 situation, with typically draconian Spanish fines and interest penalties awaiting the unaware.

26. Fines for late and non-payment of Inheritance Tax

Spanish law stipulates that any Inheritance tax due must be paid within six months of the date registered on the death certificate. If this is not complied with, then penalties are charged and interest begins to accrue.

According to Article 27.2 of the 'Ley General Tributaria' the charges for late payment of Inheritance Tax are as follows:

- Within 3 months of the deadline: 5% surcharge

- Within 6 months of the deadline: 10% surcharge

- Within 12 months of the deadline: 15% surcharge

- Over 12 months since the deadline: 20% surcharge.

In the first three scenarios, the surcharge is a percentage of the amount payable alone. In the last scenario where 12 months have elapsed since the deadline, interest also becomes payable, currently at a rate of 4.75%.

So, it can readily be seen that it is certainly in our best interests to get all of the legal issues connected with an inheritance in Spain resolved as soon as possible.

However, where a tax bill of many thousands of Euros is due to be paid and the asset inherited is a property that is not generating income there can easily arise a problem in liquidating the tax bill.

27. How to Defer Payment of Inheritance Taxes

Luckily, the governing legislation (Law 29/1987) provides for such difficult situations and allows for payment of taxes to be deferred or in instalments. The rules may be summarised as follows:

- The taxpayer may opt to delay payment of the tax or to pay in instalments where a request has been submitted within the correct timeframe

- In general, approval of a request to delay or pay the tax in instalments will incur a levy for legal interest

- The deadline for making an application to delay or pay in instalments is six months from the date of death of the testator.

- For requests of a delay of a year or less in payment of the tax it is required that the request has been made within the allowed time period and that there are not sufficient liquid assets to pay the tax

- For requests to pay instalments over five years in addition to the rules regarding requests for a delay of one year, it is additionally required that a guarantee that covers 125% of the amount of the tax and interest payable

28. Inheritance Taxes and the Family Home

Many beneficiaries have the intention of selling property in Spain that they have inherited, the title must have been transferred to them. This involves each of the heirs obtaining a Spanish NIE number and following the process for taking out probate in Spain outlined above.

Once the title is passed to the beneficiaries, note that payment of a plusvalía tax may be triggered - this will depend on the value of the property when purchased by the deceased and the current value, such that a payment will fall due if the latter is greater than the former - similar to capital gains tax in Spain.

Where the asset that is the subject of the tax is a property then the inheritance tax may be paid in instalments where:

- The application has been made within the required timeframe

- The property is required for use as a primary, habitual residence

- The size of the property does not exceed 120m ²