Anyone wishing to set-up a business in Turkey needs to adhere to the following rules and regulations:

1. Submit the memorandum and articles of association online at MERSIS

MERSIS is a central information system for carrying out commercial registry processes and storing commercial registry data electronically. A unique number is given to legal entities that are actively involved in business. Online establishment of new companies is possible on MERSIS, and already-established companies may operate through the system after the transfer of their records.

2. Execute and notarise company documents - Obtain potential tax identity number

A potential tax identity number for the company, non-Turkish shareholders, and non-Turkish board members of the company, must be obtained from the relevant tax office. This potential tax identity number is necessary for opening a bank account in order to deposit the capital of the company to be incorporated.

3. Deposit a percentage of capital to the account of the Competition Authority

At least 25 percent of the share capital must be paid in prior to the new company registration. The remaining 75 percent of the subscribed share capital must be paid within two years. Alternatively, the capital may be fully paid prior to registration.

4. Apply for registration at the Trade Registry Office

Following completion of the registration phase before the Trade Registry Office, the Trade Registry Office notifies the relevant tax office and the Social Security Institution ex-officio regarding the incorporation of the company. The Trade Registry Office arranges for an announcement in the Commercial Registry Gazette within approximately 10 days of the company registration. A tax registration certificate must be obtained from the local tax office soon after the Trade Registry Office notifies the local tax office.

A social security number for the company must be obtained from the relevant Social Security Institution. For the employees, a separate application has to be made following the registration of the company with the Social Security Institution.

5. Certify the legal books by a notary public

The founders must certify legal books on the day that they register the company with the Trade Registry Office. The notary public must notify the tax office about the commercial book certification.

6. Follow up with the tax office on the Trade Registry Office’s company establishment notification

Issuance of signature circular: After the company has been registered before the Trade Registry the signatories of the company must issue a signature circular.

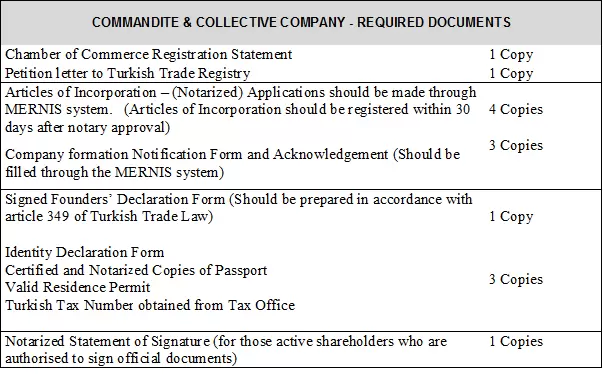

7. Documentation Required for Commandite and Collective Company Formation

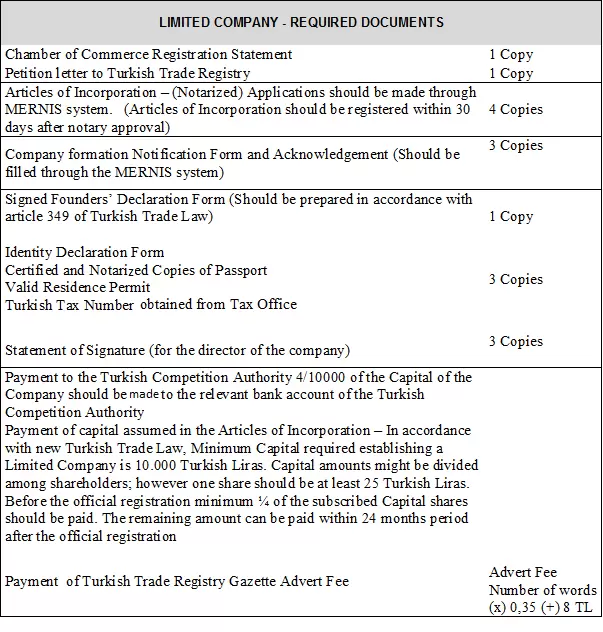

8. Documentation Required for Limited Company Formation

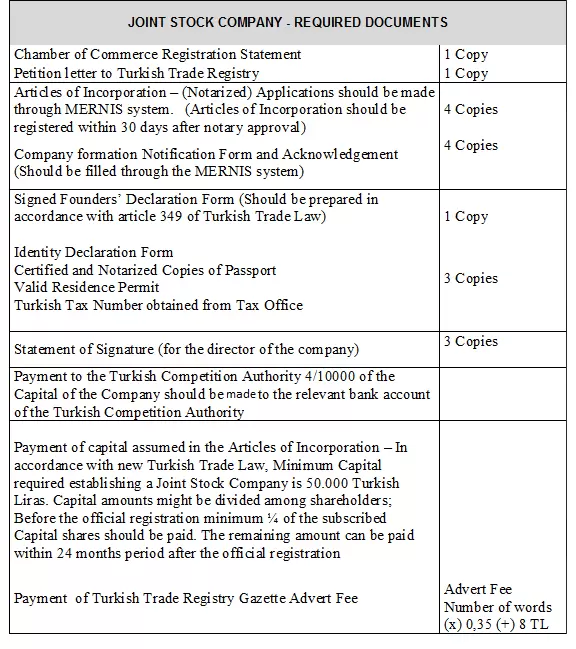

9. Documentation Required for Joint Stock Company Formation