How clients rate our Property Lawyers in Portugal...

19 Sep 2025

Get Legal and Tax Updates for Portugal?

Sign up now for our newsletter

Buying, Selling & Dealing with Property in Portugal

Our Property Law Services in Portugal

1. Buying or selling property in Portugal?

2. Landlord and tenant matters in Portugal?

All Property Law Articles

Buying property abroad in the era of higher interest rates

With the increase in globalisation and more people travelling than ever before, buying property abroad has become an increasingly popular option. International Property organisations have reported a steady rise in overseas property purchases over the past decade.This surge in popularity has been driven by factors such as lower i... Read More

Portuguese Mortgage Financing Made Clear

As a mortgage broker who has assisted foreign buyers with property purchases in Portugal, I've seen firsthand how the Portuguese mortgage market can seem like a maze. Let me guide you through the essentials.[reviews-badge][find-a-professional]Understanding the Portuguese Mortgage LandscapeThe Portuguese property market has becom... Read More

Strategies for Profitable Property Investment in Portugal

"Is this property really a good deal or am I missing something?"This question comes up often in conversations that I have with clients interested in Portuguese real estate. With property markets shifting globally and local regulations changing frequently, investors need clear, accurate information now more than ever.As a lawyer ... Read More

Portuguese Property Law

The conveyancing process in Portugal can be quite straightforward - as long as you receive appropriate independent professional guidance. If you have searched online for the ideal property then you may know that the first thing you will need to do is to get your Portuguese NIF number (fiscal number). This is quite straightfor... Read More

Why You Can't Live Without the NIF in Portugal

What is a NIF Number in Portugal?The NIF, or Número de Identificação Fiscal, is a unique tax identification number issued by the Portuguese tax authority to individuals and companies. It’s a must have, for anyone looking to live, work or invest in Portugal as it’s required for various everyday transactions such as opening... Read More

Property Tax in Portugal

As an English speaking lawyer in Portugal I have seen many clients struggle with the tax system here. Many come with misconceptions from their home country only to find unexpected costs and compliance issues. This guide will walk you through everything you need to know about property taxes in Portugal so you can make informed de... Read More

Moving to Portugal from the UK? Here are my Essential Tips

As a lawyer based in Portugal who specialises in helping British citizens relocate, I have guided many UK nationals through their move to Portugal. Since Brexit, the process has changed UK citizens moving from the UK to Portugal remains an extremely attractive and popular option.Portugal has many great features for UK nationals,... Read More

Selling Property in Portugal

Many buyers and sellers are unaware of their obligations with regard to the costs of the process of buying and selling property in Portugal. This can lead to stress and tension between the parties and even influence the decision to buy or sell a property.Whether you are a Buyer or a Seller, both parties have associated costs:Neg... Read More

Beyond the Beach: A Legal Insider's Guide to Retiring in Portugal

As a lawyer in Portugal who has helped many foreign retirees move to this beautiful country, I have gained valuable insight into what makes Portugal such a great European destination for retirement. From the warm climate and stunning coastlines to the low cost of living and excellent healthcare system, Portugal offers retirees a... Read More

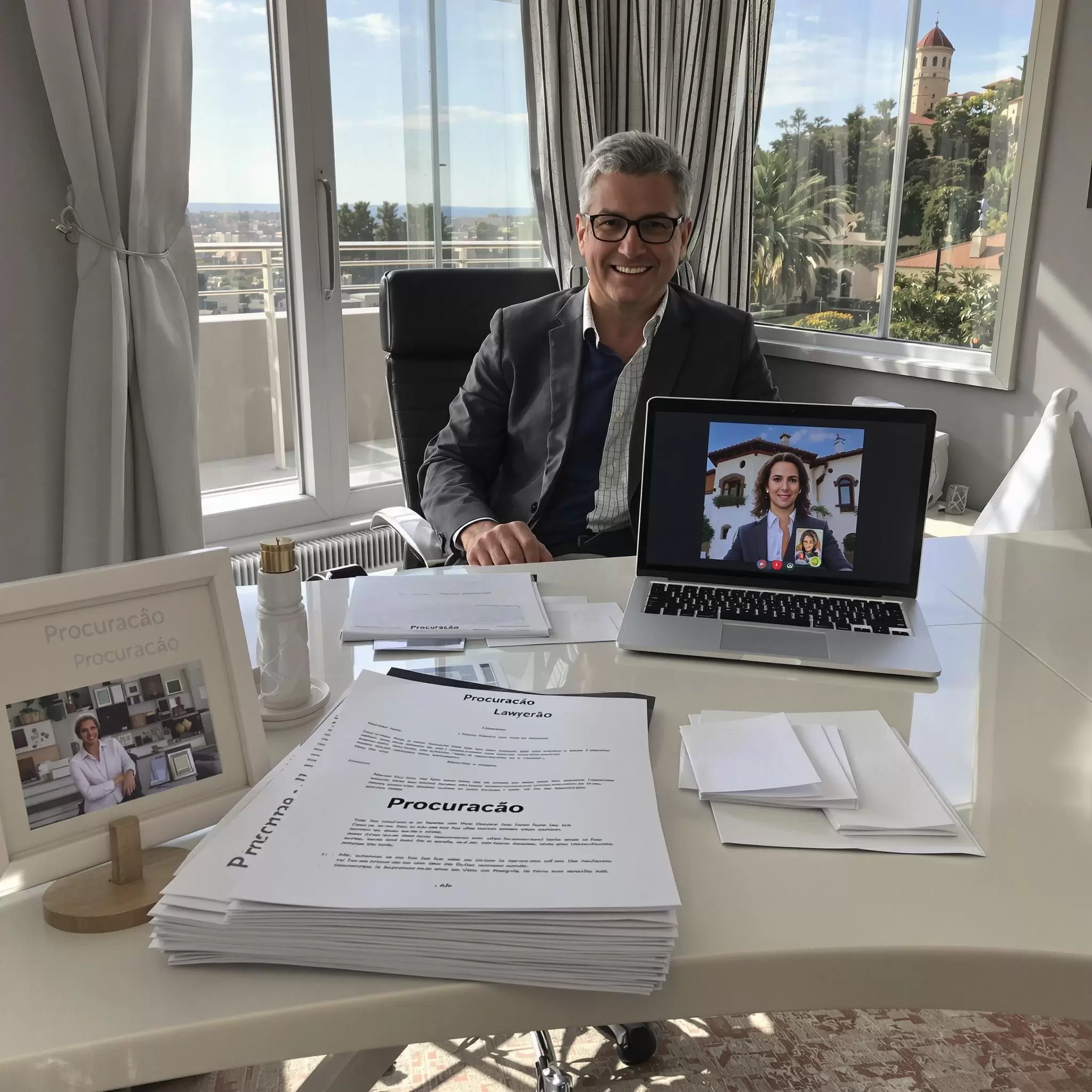

Power of Attorney Portugal: Your Legal Lifeline from Abroad

Power of Attorney Portugal: Your Legal Lifeline from AbroadPicture this: You've found your dream Portuguese villa online. The seller's ready, the price is right, but you're sitting thousands of miles away wondering how on earth you'll sign all those documents in person.Or perhaps you're managing a business in Portugal while livi... Read More

Buying Property in Portugal: the how-to Legal Guide

Welcome to the Advocate Abroad® guide to buying property in Portugal!This property guide will give you an overview of the conveyancing process in Portugal and legal requirements for real estate purchases in Portugal, including information on both your and the seller’s legal rights and obligations as well as pitfalls to avoid.... Read More