1. An introduction to Spanish Property Tax

When moving to Spain from the UK and either becoming a resident or remaining non-resident, there are taxes that must be taken into account, depending on the region and autonomous community you plan to settle in.

In this article we will explain the types of property tax in Spain due when owning or buying property in Spain, the differences that exist in tax liabilities of residents and non-residents, when taxes are paid, how they are paid, penalties if not paid correctly, and any variations across different regions or autonomous communities.

Property taxes in Spain are also linked to other types of taxes, and we explain how these are connected, so you can begin your new life in Spain with a reasonable understanding of the tax liabilities you might expect to deal with here.

2. How much Spanish property tax is payable when buying property in Spain?

One of the main costs of buying property in Spain is the Spanish government property transfer tax. The two main property transfer taxes in are:

- IVA (VAT)

- ITP (Impuesto Transmisión Patrimonial)

3. IVA (Impuesto de Valor Añadido - VAT)

The Spanish government levies VAT (known as IVA in Spain) on the purchase of a new property in Spain. The current tax rate is 10% of the property purchase price. Thus, on brand new properties, IVA is paid instead of ITP (see below).

The new property owner pays Spanish IVA directly to the promoter of the development or urbanization together with the monies to pay for the purchase of the property and the promoter is responsible for passing it on to the government in the usual way.

The one exception to this is in the Canary Islands which is not in the EU VAT area, and has its own sales tax known as IGIC. The current standard rates of IGIC in 2023 are 7%, for property purchases of value above €150,000 reduced to 5% for properties below this value.

4. ITP (Impuesto Transmisiones Patrimoniales)

The purchase of a resale property in Spain attracts what is know as ITP sales transfer tax. The precise amount you will have to pay will depend on the value of the property and where the resale property is located, with tax rates varying between 6% and 13%.

The reason the tax rate varies is because of a system of local Spanish property taxes, with each regions setting the local property tax rather than central government.

The Spanish tax authorities require this Spanish property tax to be paid within one month of the date of purchase and is carried out at the local tax office. It is the responsibility of the buyer to ensure that the tax is paid to the local Spanish tax office.

5. Land Registry Fees

The registration in the Spanish land registry of new property deeds upon the acquisition of a property attracts a land registry fee. While it is not obligatory to register the purchase in the Land Registry, it is highly recommended to protect your title and, if a mortgage is used to finance the purchase, it will be a requirement of the Spanish bank for the provision of the financing.

The fees charged by the land registry vary according to the value of the property, as follows:

| Value of Property | Land Registry Fee |

| Between €6,010.13 and €30,050.61 | €24.04 plus an additional €1.75 for every €1,000 of value |

| Between €30,050.62 and €60,101.21 | €1.25 additional for every €1,000 |

| Between €60,101.22 and €150,253.03 | €0.75 additional for every €1,000 |

| Between €150,253.04 and €601,012.10 | €0.30 additional for every €1,000 |

| €601,012.10 and above | €0.20 additional for every €1,000 |

A minimum and maximum fee has been established, such that the minimum fee has been set at €24 and the maximum at €2,181.

6. Mortgage Stamp Duty (AJD)

The creation of a new mortgage in Spain attracts the AJD tax (Impuesto de Actos Jurídicos Documentados) which is a type of old-fashioned stamp duty. The AJD tax has been devolved for collection to regional governments in Spain, though the minimum and maximum amounts are set by central government. Accordingly, the rate of tax can vary across Spain.

There has been considerable controversy about this tax, and it is certainly the highest such tax in the European Union.

Recently, the Spanish Supreme Court established that this stamp duty must be paid by the banks that issue the mortgage, with the buyer responsible only for paying some admin. fees.

Note also, a buyer will need to cover land registry fees upon the registration of new deeds of ownership in Spain.

7. Spanish property tax payable by property owners in Spain

There are a number of taxes or costs related to ownership of property in Spain. Some of these vary according to whether the owner is tax resident in Spain.

The main expenses relating to property ownership are:

8. Council Tax in Spain - IBI (impuestos de Bienes Inmuebles)

The IBI tax an annual tax paid on property ownership that is similar to Council Tax or rates in the UK. You will normally pay council tax in Spain once a year (occasionally it is billed quarterly) at the 'ayuntamiento' or town hall and the specific date that the charge falls due depends upon the individual town hall though is often towards the end of the calendar year.

Care should be taken when buying a property- especially if buying a repossessed property in Spain - given that the purchaser should pay for only those months of the year that they own the property. If the previous owner has paid for the full year then they may claim return of that portion which they will not use. The amount payable is expressed as a percentage of the 'catastral' value of the property.

The catastral value is the value of the property expressed in Euros as appears in the catastro registry. This registry is like a census of all properties in an area and the value the registry attributes to a property is taken as a reference when determining certain local administrative issues – such as the IBI tax payable.

Once the catastral value is found, the tax payable is determined by multiplying the catastral value by a coefficient or percentage. For urban property this oscillates between 0.4% and 1.1% though may be more depending on whether the property is located in the municipal capital or if more services than normal are provided. If you are buying a repossessed property in Spain, check to make sure that all out standing IBI.

9. Community Fees

Spain, similar to other mainland European countries has a much higher proportion of apartment style properties than in the UK or Ireland.

When multiple proprietors share common parts of a property such as the lifts in the building, porter facilities, the building edifice, the car-park or swimming-pool there is a cost associated with the upkeep of such shared amenities.

Accordingly each proprietor is required to contribute financially to the upkeep by way of a community charge, known in Spain as 'la comunidad'.

The amount payable varies from building to building or urbanization to urbanization but will also be determined by the property owned within the building (some properties are larger than others and therefore should pay a larger share).

For property buyers, an important point to note is that when buying a flat in Spain in a building or community assumes the debts and pending community charge for the previous and current years.

For this reason the seller is required to present the purchaser with a certificate of proof of payment of the community charge unless the purchaser has expressly waived this requirement. This will be checked by your lawyer in Spain.

10. Other Charges

In addition to the main taxes and charges outlined above it may be necessary to make provision for other ancillary charges such as rubbish collection and water rates.

If a community charge is being paid then this will most likely include the charge for collection of rubbish but if the property is a separate building such as a villa with its own rubbish bins then it may not be.

Likewise the supply of water may be included in any community charge but in the absence of one will need to be paid for as is the case with other utilities. Some autonomous communities are introducing water meters in an effort to reduce consumption.

11. Non Resident Income Tax in Spain

Non-resident property owners in Spain are liable to pay a tax known locally as IRNR. This type of Spanish income tax is an annual 'imputed income tax' based on the the catastral value of the property. The 'taxable base' is 2% of the cadastral value of the property (1.1% if this value has been revised during the last 10 years), and the tax rate is 24% for non EU residents (19% for non-residents that are tax resident in an EU or EEE State).

If the property is rented to 3rd parties, then the property owner should pay income tax on any income derived from the rental of the property.

EU residents have a personal income tax rate of 19% payable to the Spanish tax office on the Spanish i.e. after costs and expenses have been deducted from the taxable income. However, non-EU residents - including UK rental income residents - pay a higher rate of 24% on the gross income from the rental of the property.

That is to say that expenses and costs related to the rental may not be deducted. Brexit introduced an additional complication for British citizens buying property.

This makes a considerable difference especially since one of the main expenses - amortization costs - are equal to 3% of the constructed value of the property.

While EU residents may deduct any costs that are directly related to the generation of the rental income (e.g. agents fees, cleaning, laundry, repairs and maintenance), all other costs e.g. local rates, community fees, utilities or interest on bank mortgages may only be deducted pro rata to the number of days the property is rented during the tax year.

For the number of days, within the tax year, that a property is not rented out, it remains subject to imputed income tax as explained at the beginning of this section. The tax form is called Modelo (Form) 210 and the deadline for the payment is 31 December each year.

12. Filing income tax return for rental income

In addition to filing the above annual tax, when you rent out Spanish property, whether as a long or short-term rental (i.e. holiday home or seasonal let), you also need to file and pay quarterly (January, April, July and October) the non-resident income tax in Spain.

Rental income should be declared just as any other income. In fact it comes under the heading of -'rendimientos de capital inmobiliario'. There are important deductions that can be made that drastically reduce or eliminate any tax payable on income of this type.

Firstly you may deduce any bills such as the mortgage interest payments as well as amortisation costs (at 3% of the property) as well as any charges such as IBI and rubbish collection. Also deductible are insurance costs and the costs of professional services such as an accountant to calculate tax liability. Finally any expenses involved in the refurbishment or repair of the property may be deducted from the taxable income.

Once the yearly expenses have been calculated and deducted from the rental income, you have reached the net tax payable but this is not the final result.

Unfortunately, for tax residents in the UK, they are now considered non-EU residents and so they cannot deduct expenses involved in the rental of the property.

On the days a property is effectively not rented out (think short-term lettings) a landlord is still liable for Non-Resident Imputed Income Tax on a pro rata basis (see section regarding non-rented property above). Put simply, one way or another, you pay tax on the property every day of the year.

Following the double taxation treaty between Spain and the United Kingdom, non-resident landlords need to file and pay tax on their rental income in the country where the real estate asset is located.

So, for example, if a British national owns property in Murcia (Spain) and rents it out as a holiday home during summer, they must declare and pay tax on their rental income to the Spanish Tax Office.

If this British landlord is declaring and paying his Spanish derived rental income only in the UK, where he is tax domiciled, he would in fact be breaching Spanish tax laws.

Thousands of foreign property owners in Spain make this mistake and are going to get into trouble with the Spanish Tax Authorities. UK tax domiciled owners need to declare and pay tax on their rental income in both countries.

Following the double taxation treaty, HM Revenue & Customs gives tax breaks on any rental income tax paid in Spain, so you will not have to pay tax twice.

13. VAT on Rental Income

Note also, that if you are renting-out a property in Spain, then normally this type of activity would be considered to be exempt from VAT. However, that will not be the case if your tenant decides to begin carrying-out a business activity in the rented property. When anyone is starting business in Spain, there is an obligation to deduct VAT and then make the corresponding quarterly VAT declarations to the Spanish Tax Office. This means you should add to the agreed rent, 21% VAT (IVA in Spanish).

In addition, the Spain rental VAT should be calculated on the total rental income to be paid by the tenant even if the tenant is only going to allocate part of the home to economic activity (for example, even if only a single room is required for carrying-out the development of the economic activity and the rest of the house is intended as a habitual residence).

Since this can add to your outgoings, then it should be a factor when considering whether the purchase is economically viable.

14. Wealth Tax

Wealth tax.- Resident and non-residents in Spain may also be required to pay tax on their overall wealth, should the value of their assets exceed €700,000 (though only €500,000 in Cataluña). There is an additional €300,000 exemption applied to property assets in Spain.

For a Spanish resident, the wealth tax is evaluated in relation to their is their total worldwide assets, while for non-residents wealth tax applies only to their Spanish assets. So, for non-residents with property valued at under €800,000, there is no wealth tax to pay, regardless of where the property is location in Spain.

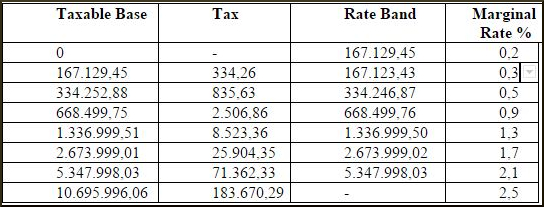

The tax bands and tax rates are as follows:

The tax form is called Modelo 714 and the deadline for the payment is on 30 June each year.

15. How much Spanish property tax is payable by property sellers in Spain?

When selling a property in Spain, the resident and non resident property owner are again caught in the tax authorities cross-hairs.

There are two principal taxes payable here, though again, the tax varies according to the amount of any gain in value since the time it was purchases, and whether the seller is a Spanish tax resident (also EU/EEE tax residents) or a non resident.

16. Tax on Profit when Selling a Property

This tax, just as in the UK or Ireland, is payable on any capital gain or profit derived from selling Spanish property (for Spanish tax residents, this applies to worldwide property assets). The capital gains tax rates in Spain are as follows:

- Up to 6.000 Euros: 19%

- From 6.000 to 50.000 Euros: 21%

- From 50.000 Euros to 200,000 Euros: 23%

- Above 200,000 Euros: 26%

It is usual in the case of non-resident sellers that the purchaser will retain 3% of the stated purchase price to liquidate this tax on behalf of the seller. Should the 3% not cover the entire liability then it is possible that the Spanish revenue will seek an additional payment from the vendor at a future date.

On the other hand if 3% is greater than the Capital Gains liability then any surplus may be reclaimed. This should be carried out within three months of the sale via the relevant local tax office.

17. Exemptions to Tax on Gains

As well as deducting the initial purchase cost of the property, any costs incurred in improving or adding to the property may be deducted before applying the tax.

A special deduction applies to any homes purchase before 1994 and applies differently depending on when the property was sold. Perhaps the most important exemption for Spanish residents that exists is the 'exención por reinversión' or exemption where the proceeds of the sale of a property are reinvested in another property.

In order for the exemption to apply the property must have been your habitual residence (as legally defined) and the proceeds must be reinvested within a period of two years following the sale of the old property. Upon leaving the European Union, UK residents do not qualify for this exemption and must pay capital gains tax at the full rate.

Those over the age of 65 when selling the property and who have lived in the property for the prescribed period of time will benefit from this exemption regardless of whether they reinvest it or not. For an indepth review of capital gains tax, please see our article on Capital Gains Tax in Spain.

18. Plusvalía Tax

This is a local property tax payable upon income derived from the sale of property, on the purported increase in value of the land on which the property is situated, during the period of the seller's ownership of the property.

This has been a highly disputed tax as a resultof the often spurious and random valuations by the local tax authorities. As a result of a decision by the Spanish constitutional Court in 2021, the tax was ruled to be unfair and should only apply where there has been a real increase in the value of the property.

19. Who has to pay the tax?

According to the Spanish tax agency, the seller of the property has the responsibility to pay the tax and so once again care should be taken that there is no clause in the contract for purchase that states that the buyer is responsible for the plusvalia tax, unless of course this agreed to: just another example of one of the pitfalls of buying property in Spain.

The are two principal methods of calculation of this tax, and the seller may choose whichever results in the least onerous.

20. Exemptions to Plusvalía

There are some important exemptions from paying the plusvalia tax. For example the transfer of a property pursuant to a court order in a divorce does not attract the payment of tax.

If you bought the property before 1986 or if the property is your habitual residence and you are more than 65 years old then you are exempt from the tax.

Discounts are also possible such as when a property is inherited by a close family member. In such a case any plusvalía tax payable may be reduced by 95%. There are conditions attached to this discount such as not selling the property for a period of time following the death of the original owner.

21. Spanish Inheritance Tax

For completeness, we must also consider the effect of inheritance tax that will eventually need to be paid should the owner of the property die while retaining the ownership of the property in Spain.

This is a complex area of Spanish tax law, and quite different to Anglo-Saxon jurisdictions. We would recommend that you read our articles dealing with Spanish Inheritance tax.

The Spanish tax system permits important deductions when the property is passed to close family upon the death of the owner. However, inheritance tax is determined at a regional level, and so the specific deductions that are applicable, will largely depend on the location of the property and the place of residency of the deceased.

22. Property Transfer Taxes in Spain by Region

The Spanish central government devolved legislating powers for the setting of property tax rates to the seventeen autonomous regions of Spain (Real Decreto Legislativo 1/1993). This means that the rates can vary from region to region with each local parliament offering in some cases tax deductions to different groups of society that they feel should benefit from fiscal support.

So, you should bear in mind that the tax rates that apply will vary according to location, and - often - value of the property.

23. Conclusion

As can be seen, there are a number of important tax implications when purchasing a Spanish property and it is unavoidable that you will have to pay Spanish taxes.

However, as we have discussed above, your specific tax liability will be determined by your individual circumstances, in particular if you are tax resident in Spain. (Note: if your tax residency is considered to be in Spain, you will be subject to income tax on your worldwide income).

Of course, by speaking to a tax specialist in Spain you can explore the possibilities of obtaining a tax reduction.