Since the 1980's, Spain has attracted people from around the world, and particularly northern-Europe, to live and work in the country. Often, the work they would do was related in some way to the tourism trade, including tour reps, bar staff and more recently property sales (including the dreaded timeshare sales!).

While initially many of these workers had 'irregular immigration status', the emergence of the European Union and free movement of workers provided a formal structure, at least for citizens of the European Union to establish themselves legally with a visa in Spain - either as an employee or, less frequently, as a self-employed person.

New technologies have made the prospect of distance working a reality for many, and now hundreds of thousands of people from around the world have chosen Spain as their base to work from.

Such workers are no longer tied to the tourism sector, and are able to set up a wide variety of businesses in Spain, though typically they continue dealing with clients either solely from their home country or with clients from around the world, since language continues to be a barrier.

Of course, this option is relatively straightforward for European Union citizens, but rather more complex for those from outside the EU - including British citizens, following Brexit. Non-EU citizens must obtain a residence permit as well as a work permit in order to carry on business in Spain.

Spain, like other countries, does offer a range of visas that allow foreigners to live and work in the country. For those who are - or plan to become - self-employed, one option is the self-employed work permit in Spain. For those who simply wish to relocate to Spain, while benefiting from a pension or other passive income, the non-lucrative visa in Spain is ideal.

Below, we shall consider the process for applying for the self-employed visa in Spain, and consider the merits and the downsides, as well as alternatives and some practical steps for those planning on becoming a self-employed entrepreneur in Spain.

Want to hear what other clients

are saying about us?

1. Application process for a self-employed work visa for Spain

People are understandably somewhat confused by immigration processes. Firstly, it is useful to get used to the various terms that are used.

A visa in Spain is an authorisation for a person to enter a country for a particular purpose and for a specific period of time. Spanish visas are typically issued by the Spanish Consulate of the country of origin of the applicant (or nearest Spanish embassy if no Consulate), following payment of the visa application fee, submission of the visa application form and other ancillary documentation required by the Spanish authorities to demonstrate they meet the requirements of the visa, though occasionally they may be issued by the Spanish government directly, in Spain.

The purpose for which a visa is granted may vary - it can be to live in Spain, to live and work, to make multiple visits for business purposes, to set up a business and so on. For this reason you may hear the terms: residence visa, Spain Freelancer Visa, self-employed work permits etc

The term 'visa' is often used interchangeably with 'residence permit' or 'work permit' - though these are general terms typically used to describe what the visa permits the applicant to do, rather than a specific document.

Once a visa has been issued, the applicant must collect the visa, usually at the nearest Spanish consulate and then, within a specified period of time, register with the local Spanish authorities in the area of Spain in which they plan to live. At this stage, they will receive their residency card, which can be used as proof of identity.

Normally, most visas authorise an initial temporary residence permit, though this may be renewed at the end of the initial period, often for a longer period, until, should the visa holder remain resident in Spain for a period of 5 years, and continue to fulfil the visa requirements, they may apply for permanent residency, with no need to continue renewing their visa.

2. Legal Process and Requirements for a Self Employed Visa in Spain

- The applicant must be over the age of 18, not being a citizen of an EU or Schengen State, and intend to carry on a business activity in Spain

- The applicant may not be legally barred from entry to Spain (this would include those living irregularly in Spain, under an expired visa)

- The application must be approved by the appropriate foreigner's office in the area of Spain where the business will be registered

- The foreigner's office will want to see evidence that the applicant has sufficient financial means to establish the business, including premises, marketing resources, hiring of staff. While the regulations do not specify the amount that would equate to sufficient financial resources, it should be sufficient to establish the type of business envisaged by the applicant, and may require many tens of thousands of Euros

- Once the visa has been authorised, the interested party will have 1 month from the date of notification to collect the visa (in person) at the corresponding Consular Office

- The visa holder must travel to Spain and present to the border authorities the same travel document that was used to process their visa and in which it appears

- Once entry to Spain has been authorised by the border authorities, the visa holder must ensure that their passport is stamped; if entering Spain from a Schengen State and therefore without crossing external borders, you must, within a maximum period of 3 business days, go to a Police Station or a Foreign Nationals Office in order to sign an entry declaration

- The interested party will have a maximum period of 3 months from the day following the date of the entry stamp or from the signing of the entry declaration to register with the Spanish Social Security, and 1 month from said registration to apply to the corresponding Foreign Office for the Foreigner Identity Card (TIE).

- The visa when issued authorises initial temporary residence and self-employment of 1 year, limited to a specific autonomous geographic scope and to the economic activity sector for which it was requested.

- Note, this visa does not permit family members to gain a residence permit via the family reunification process.

- If the visa application is rejected, it will be communicated to the applicant in writing, explaining the reason for the rejection and detailing the missing supporting documentation or circumstances and the bodies to which they must be presented.

- Licencia de Apertura: For certain business activities, you may need to obtain an opening license (Licencia de Apertura) from the local municipality. This is particularly important for businesses that will operate from a physical location accessible to the public.

- Professional Association: Depending on your profession, you may be required to register with the relevant Professional Association (Colegio Profesional) in Spain. This is common for regulated professions such as lawyers, doctors, and architects.

- Legal Status: You must decide on the legal status of your business, whether it will operate as a sole proprietorship (autónomo) or a limited company (Sociedad Limitada). This decision will affect your tax obligations and personal liability.

3. Documents Required For the Spain Self-Employed Work and Residence Permit

- Copy of all the pages of the passport, including the blank ones.

- Application form for authorisation of residence for self-employment: Form EX-07 (1 copy), duly completed and signed.

- Proof of payment of the visa fee: Form 790-052. If planning to set up business in Cataluña, Form 790-062 must be sued to demonstrate proof of payment of the application fee

- List of the licences required for the installation, opening or operation of the planned business activity, indicating what stage or progress has been made in the applications for said licences including documental verification, from the appropriate public bodies, of those applications having been made. As an exception, for retail commercial activities and service provision to be carried out in permanent establishments with an area not exceeding 750 square meters, no prior municipal authorisation or licence is required for opening, being replaced by evidence of prior communication with the responsible Spanish Administration, together with proof of payment of the corresponding administrative fee for said licence.

- Professional and academic certificates accrediting the training and, where appropriate, the professional qualification legally required for the exercise of the profession that is planned to be carried out in Spain and, where appropriate, the qualification recognized in Spain when it is essential for the exercise of the planned profession.

- A detailed business plan describing the activity to be carried out, indicating the planned investment, its expected profitability and, where appropriate, the jobs whose creation is planned. This should be done in conjunction with an experienced immigration lawyer in Spain who can ensure that the content of the business plan includes the information required.

- Documentation accrediting that the necessary economic investment for the implementation of the project is available, or sufficient support commitment from financial institutions or others.

Upon receiving authorisation from the foreigners office in Spain, the applicant must send the following documentation:

- Original of passport: A valid national identity card or passport from your country of origin

- Criminal record check certificate to show that the applicant does not have criminal records in any countries in which they have been resident over the 5 years prior to the application

- National visa application form (2 copies).

- 1 photograph

- Negative medical certificate that accredits not suffering from any disease that could have serious repercussions on public health, in accordance with the provisions of the WHO International Health Regulations of 2005

- Proof of having paid the corresponding Consular fee

- Proof of Sufficient Funds: Bank statements or other financial documents demonstrating you have enough money to support yourself and your business.

- Translation of Documents: Any documents not in Spanish must be officially translated by a sworn translator recognized by the Spanish authorities.

- Apostilled Documents: Certain documents, such as criminal record checks, must be legalized with an Apostille stamp from your home country.

Once the applicant has been approved for a self-employed work visa, they must travel to Spain and, having had their passport stamped on entry, proceed to register at the local foreigner's office in the location that they have chosen to set up their business.

Upon arranging an appointment at the relevant office (or national police station if no local foreigner's office), the visa holder will provide a copy of fingerprints and obtain their TIE card - which is their identity card.

4. What is the Processing Time for a Self-Employed Work and Residence Permit?

There is no specified time-frame for the Foreigner's Office to make a decision on an application for a self-employment visa. However, once the visa application has been approved, the applicant has 1 month to request the visa from the appropriate Spanish Consulate. The Consulate should respond to this request within one further month.

Once approved, the applicant has 1 month to retrieve the visa, requiring the applicant to visit the Consulate personally, so their passport can be updated. The applicant must collect the visa from the Consulate where the application has been made, and failure to pick-up the visa within the specified time will result in the visa being revoked.

If the application has been refused, the applicant should receive a response informing the applicant the reasons why.

Once the visa holder enters Spain, they have 1 month to obtain their Foreigner's Identity Card at the appropriate Foreigner's Office/Police Station and 3 months to register with the Spanish Social Security system.

5. How to register as self-employed in Spain

Having successfully completed the immigration process for obtaining a self-employed visa, the next step is to actually set up the business. In order to do this - regardless of whether the business will be run as a limited company or as a freelancer - to be a self-employed person (autonomo in Spanish) in Spain it is necessary to register with both the tax agency and the Social security system in Spain.

In order to register as an autónomo with the Spanish Tax Authority, it will be necessary to open a Spanish bank account first. It will be from this bank account, typically, that your taxes will be paid from. It is of course also possible to open an account in the name of a limited company, however, in order to be the owner-director of a limited company in Spain, it is a requirement to be registered as self-employed in Spain.

The registration takes place at the nearest offices of the Spanish Tax agency, where form 036 must be completed, including name, address, NIE number, business category/sector and whether VAT (IVA) will be charged for the activity to be carried out.

Once registered with the tax authority, you will receive your Foreigner Registration Document, which serves as proof of your legal status as a self-employed individual in Spain. This document, along with your Identity Card (TIE - Tarjeta de Identidad de Extranjero), will be crucial for various administrative procedures related to your business and residency in Spain

6. Social Security for Self-Employed in Spain

All workers in Spain -whether employees or self-employed, must make social security contributions to the state social security system (Seguridad Social).

In Spain, social security payments to be paid by those in self-employment are made on the basis of their income as well as with reference to the expected benefits that may be received.

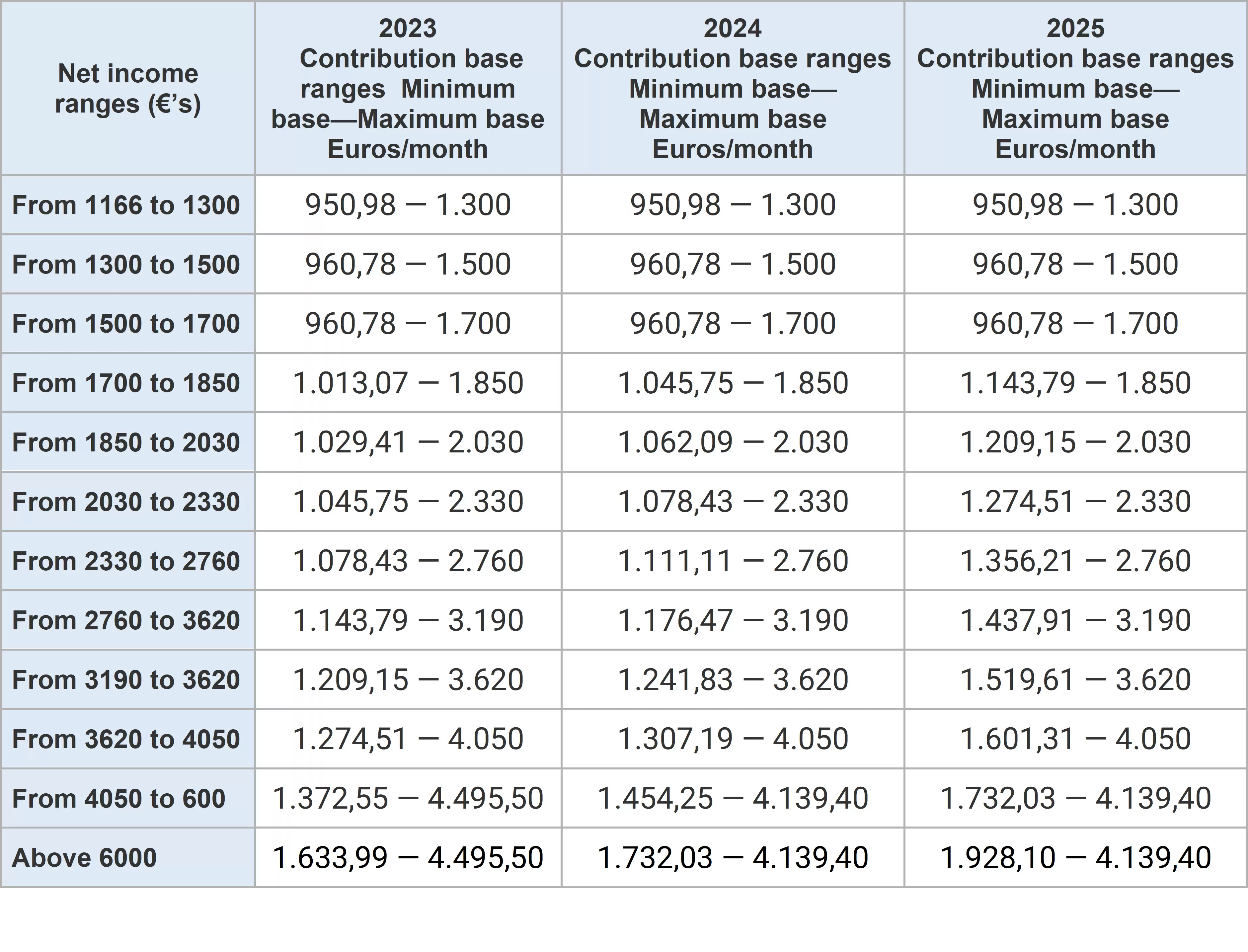

In 2023, the government released a new set of tiered payment thresholds in order to bring the contributions made by the self-employed more into line with the amounts paid by regular employees. Of course, traditionally the self-employed have been entitled to fewer benefits than employees, a fact that the government conveniently sought to play down. That said, some modifications were introduced to increase the benefits that self-employed workers might ultimately obtain

Payments for new self-employed persons who have not been registered as self-employed in Spain in the prior 2 years are to be maintained at €80 per month for the first 12 months, without change in the next 12 months should the income of the self-employed person not exceed the minimum interprofessional salary (around €13000 per year) during the first year of business.

7. New Income and Social Security Contributions in Spain

As per the table above, the amount you pay after the initial 2-year period is determined by your net income, and also upon minimum and maximum ‘contribution bases’, such that once you have determined your net monthly income, you can then decide on the contribution base, from a minimum to a maximum quota (providing the minimum amount of benefits in return). Your monthly social security contributions are a percentage of the quota.

After this period, social security payments begin at €230 per month for those with income of €670 or less per month, and increase to €500 per month for those earning €6000 or more. This would be assuming the self-employed person person on such incomes has chosen the minimum quota. The highest quota would require corresponding social security payments of €260 and €1267 per month at these income levels.

8. Advantages and Disadvantages of Being Self Employed in Spain

One of the main disadvantages of being a self-employed worker in Spain is that you will be required to manage your tax labilities, including income tax and VAT returns.

Self-employment in Spain usually means hiring a bookkeeper or accountant to manage your invoicing and tax returns. This is because for most foreigners in Spain, dealing with taxes is too complex, given the language barrier and the fact that Spain has its own, unique tax system which is different from any other country, and the fines for failing to meet your tax obligations can be very high.

That said, even employees in Spain - who are also required to make an annual income tax return - will often request assistance from an independent professional., although their tax obligations will normally be somewhat less complex than a self-employed worker.

On the other hand, as a self-employed worker in Spain you will be able to deduct business expenses, including a percentage of utility bills should you use your home to work from.

9. The difference between setting up a limited company and becoming a freelancer in Spain

Should you prefer to use your self-employed work visa to set up a Spanish limited company, you will be able to benefit from limited liability. This may be important to those operating businesses in certain sectors.

Bear in mind though that the accounting obligations are rather higher for limited companies than for self-employed workers, with the submission of annual accounts required. Typically the accounting costs will be approx. 4-5 times more expensive if using the limited company structure to operate your business in Spain.

10. The Difference Between an Entrepreneur Visa and a Self-Employed Visa

The entrepreneur visa differs from the self-employed visa in that it is designed for those individuals who are setting-up innovative businesses in Spain that do not already exist and which are also compatible with the 'special economic interests' of Spain. Effectively it must be considered to be capable of generating wealth and employment for local Spanish people.

Obviously enough, therefore, it is only applicable to those who are genuinely setting-up innovative businesses and therefore would not be appropriate for those who wish to operate a typical business such as a bar or web-design business.

It does have some significant advantages though, with the visa including a 3-year residence permit and the holder able to bring their spouse/partner and children.

The Spain freelance visa or self-employed visa is ultimately easier to obtain, as the self-employed individual is not required to demonstrate innovativeness nor compliance with Spain's economic interests.

11. Best Alternative to Self employed Visa

A new and interesting alternative to those interested in obtaining a self-employed visa is the Spain digital nomad visa. This visa is appropriate for non-EU citizens who have been working as self-employed and billing clients for a period of at least 3-months.

As long as your Spanish clients do not represent more than 20% of your income, you can obtain a visa with 3-years residence permit (if applied for in Spain, while on a tourist visa, for example, or via a legal representative in Spain).

The only drawback with the digital nomad visa is that it is still relatively new and this is causing delays when the visa application is processed by one of the Spanish Consulates as well as a lack of information forthcoming by the Spanish immigration authorities.

Nonetheless, this new visa represents a very interesting alternative to the self-employed who are interesting in transferring the business operations to Spain.

12. Taxation for autónomos in Spain

Income tax for the self-employed, or 'autonomos' (as they are known in Spain) is, well, a bit complex.

As with employees, the personal income tax rates are split between the central government and the regional community in which you live. However, as a basic estimate, for the 2022 tax year (Spain's tax year runs from January - December i.e. the calendar year), you can expect personal income tax rates as follows:

- Up to €12,450 in earnings, 19% is applied

- From €12,450 to €20,200, 24% is applied

- From €20,200 to €35,200, 30% is applied

- From €35,200 to €60,000, 37% is applied

- From €60,000.01 to €300,000, 45% is applied

- From €300,000 onwards, 47% is applied

The specific percentages to be applied will depend on the regional community in which your business is located.

The above personal income tax rates apply to the net income, i.e. after business expenses have been deducted. In Spain, the self-employed may deduct the following categories of business expenses:

- Social security payments

- Rental costs of business premises

- Utilities such as electricity, water or heating

- Property taxes

- Telephone and internet costs

- Office supplies

- Assets purchased for the purpose of business e.g. computers, office furniture, etc.

- Consulting or advisory expenses

- Financial expenses (card commissions or interests derived from loans and credits)

- Allowances for travel and trips

- Online tools (like your billing and accounting software)

- Insurances (medical, life, liability)

You should always submit such expenses to your accountant/bookkeeper, to make sure they may be claimed, as rules in Spain may differ from your country of origin and the tax authorities may not accept certain expenses

The annual tax return is completed each year at some point between the beginning of May and the end of June, for the previous years income. However, the self-employed are required to make payments ahead of this time, through what are known as retentions.

Retentions are made by clients of the self-employed by way of a retention applied to each invoice. Normally this is 15%, but a special rate of 7% applies to those who have been registered as self-employed for a periof of less than 3-years.

So, if you are billing a business client €1000, you would need to apply a deduction/retention of 15% or €150 as a listed item in the invoice. The client must then dutifully pay this amount at the required time directly to the tax agency. Note retentions are not applied where the client is located outside of Spain.

Don't forget you must apply the appropriate VAT rate as well (typically 21%). So, the items on the invoice may look something like:

Invoice amount......€1000

IVA @ 21%..............€210

- Retención @ 15%...€150

Total to Pay.............€1060

Want to hear what other clients

are saying about us?

13. Frequently Asked Questions

What visa do I need to be self-employed in Spain?

To be self-employed in Spain, you need to obtain a Self-Employed Work Visa. This visa is for individuals aged 16 or over who wish to engage in self-employed activities. The process involves two stages: first, you must obtain an initial residence and self-employed work permit. Once you have this permit, you can then apply for the self-employed work visa. This visa allows you to legally reside and work independently in Spain.

How do I prove self-employment in Spain?

To prove self-employment in Spain, you will need to present several documents, including:

- A copy of your passport.

- Completed and signed application form EX-07.

- Professional and academic certificates demonstrating your qualifications.

- Proof of sufficient financial means to support yourself.

- A detailed business plan outlining your proposed activities.

- Evidence of necessary licenses or permits for your business.

How much tax does a self-employed person pay in Spain?

A self-employed person in Spain pays Personal Income Tax (IRPF) based on their taxable income, with the following rates for 2024:

- 19% for income up to €12,450

- 24% for income between €12,450 and €20,199

- 30% for income between €20,200 and €35,199

- 37% for income between €35,200 and €59,999

- 45% for income between €60,000 and €299,999

- 47% for income over €300,000

These rates apply progressively, meaning higher portions of income are taxed at higher rates.

Do you have to pay to be self-employed in Spain?

Yes, being self-employed in Spain involves several financial obligations. As a freelancer, you must pay your own taxes and VAT (21%) by registering with the tax agency (Agència Tributària or AEAT). Additionally, you need to pay a monthly social security fee, which starts low but over a period of 2 years gradually rises to around €294.