Are you an English-speaker thinking of buying property in Spain in 2025?

If so, you're not alone.

In 2023 - the last full year for which we have statistics - more than 87,000 properties were purchased in Spain by foreign buyers. This represented 15% of the total number of conveyances that took place, up from 13.7% the previous year.

However, with so many factors to take into account when buying a property in Spain, it is completely natural to feel overwhelmed. Don't worry.

Purchasing property in Spain is a significant decision that involves understanding the Spanish property market, legal requirements, and associated costs. Foreign buyers often find Spanish properties attractive due to the diverse offerings and relatively lower property prices compared to other European countries.

Below you will find a ‘dummies guide to buying property in Spain'. We assume you are starting-out with no prior knowledge of the subject at all and We make sure to highlight any potential pitfalls when investing in Spanish property.

We will take you by the hand through immigration matters, location questions, current market conditions, the property conveyance process and finish by answering some of the most frequently asked questions.

We will begin by one of the biggest changes that lawyers in Spain have recently had to deal with:

1. Buying Property in Spain after Brexit

Since many of our clients are from the UK, a common topic is whether British citizens can buy property in Spain after Brexit. In reality, this is a question about their ability to gain residency and the required process.

The reality is that property in Spain remains a popular choice for British expats, despite the changes brought by Brexit.

British nationals, now legally non-EU nationals, have different residency rights from prior to Brexit. We have detailed information on Brexit's impact on British citizens buying property in Spain and buying property abroad for those buying property in other European countries.

Despite Brexit, many British expats continue to buy property in Spain, attracted by the country's climate and lifestyle. Retirement in Spain is still an achievable goal!

In fact, the Spanish government has implemented measures to facilitate property purchases for foreign buyers. British citizens should be aware of the requirements for obtaining residency and the implications for property purchases - see more in moving to Spain from the UK.

2. Tax implications of Brexit for UK tax Residents Buying Property

Should a British citizen become resident in Spain, then they are resident for tax purposes. However, even if the person buying a house in Spain after Brexit does not intend to become resident, there are a number of tax implications that flow from Brexit nonetheless.

This is a complex area since each person's tax liability depends on their individual circumstances. For this reason we have devoted an article to property tax in Spain. We briefly outline the main considerations below:

3. UK Nationals Resident in Spain

If you are resident in Spain then you are liable to the Spanish government to pay taxes on your worldwide income. This would include income tax if you are working in Spain or rental income tax if you have income derived from investments or rental income from property outside Spain.

In Spain all tax residents must make a declaration of income once per year, by 31 May, covering income from the previous calendar year. So, for the income period of the 2022 calendar year, the income tax declaration must be made by 31 May 2023.

Those who are tax resident in Spain (both local Spanish residents and expats resident in Spain) are legally obliged to provide information to the Spanish government (tax authorities) regarding any offshore accounts, offshore investments, and real estate located abroad.

It should be noted that tax form 720 does not imply additional taxation (it is an informative form).

The deadline is the 31st of March each year. In this respect, it is noteworthy that, currently, the Spanish system of rental income tax permits a deduction of 50% of gross rental income before being required to pay tax on the net amount,

4. UK Nationals Not Resident in Spain & Rental Income

Before and since Brexit many UK citizens have bought property in Spain, not with the intention of living in Spain, but simply of being a property owner in Spain and using the property as a holiday home so they can visit Spain regularly to enjoy the lifestyle here.

Whether buying a property in Spain after Brexit - or before - UK tax residents are liable to pay a non resident income tax. This is a tax that is based on the imputed income from the property in Spain as if it were taxed. Don't let it be said that the Spanish are not imaginative when it comes to taxes!

The tax rate applicable will change from 19% to 24% of the rateable value, owing to the change in status of the property owners from EU to non-EU citizens.

Another major change brought about as a result of Brexit affects the taxes involved in relation to income from rental property in Spain.

Under Article 24.6 TRIRNR (the relevant legislation regulating the taxes payable by any EU citizen who derives an income from rental properties in Spain) ceases to apply to UK nationals.

Accordingly, such UK nationals will no longer be able to deduct rental expenses such as rates, community fees, insurance, amortization, repairs and small miscellaneous expenses etc from the monthly rental income.

Also, just as with those who pay tax under the IRNR imputed income tax in the previous paragraph, the tax rate will increase from 19% to 24%. Something of a double-whammy for those British citizens who are in this situation.

5. Changes to Capital Gains Tax as a result of Brexit

The major difference here as a result of Brexit is that, previously, UK citizens, as EU citizens, were entitled to an exemption from payment of Capital gains tax when the proceeds of the sale of the primary residence were reinvested in another property in Spain for residential purposes.

Following Brexit, as UK citizens are obliged to pay capital gains tax as non-EU residents, any such sale and reinvestment will be subject to Capital gains tax, at a rate between 19% - 26% of the gain in value of the Spanish property.

6. Will British citizens have any problems visiting their properties in Spain?

Regardless of residency rights, British nationals are, of course, still able to visit their property in Spain and stay for up to 90 days in any 180-day period, even after Brexit. For many however, this may not be sufficient.

With a standard tourist visa, included in a British passport, you can stay for up to three months without having to get any official document or special permission from the Spanish authorities.

British citizens need to understand the visa requirements for extended stays in Spain. While short visits of up to 90 days are generally hassle-free, longer stays necessitate a residency visa. This is essential knowledge for those considering buying Spanish property.

So, before you begin checking the listings of houses for sale in Spain, note that non-EU foreign buyers including Brits buying property in Spain don't automatically get residency in Spain just because they are property owners there.

Foreign buyers need to be aware of the visa requirements for extended stays in Spain, ensuring compliance with the Spanish government regulations.

That said, unless you have been living in Spain before the cut-off date, and fulfil the criteria for proving this, then if you are a British citizen you will need to obtain a residency visa in order to stay more than 90 days at a time. There are a number of options for Spanish visas for those considering a move to Spain:

-

Golden Visa Spain: Buying a Property worth over €500,000 (may be time-limited according to the Spanish government's most recent announcements of an intention to end this route to residency).

-

Non-lucrative visa Spain (visa that entitles the bearer to reside but not work in Spain)

-

Have access to another EU Passport e.g. Irish passport due to a grandparent's ancestry or marriage to an EU citizen (Family Reunification Visa)

Want to hear what other clients

are saying about us?

For those living in Spain after Brexit, and who are able to gain residency in Spain via one of the visa options above, your first decision may well be whether you want to purchase or rent a property in Spain.

7. Should you buy or rent property in Spain?

Consider if renting suits your needs before buying. Renting helps you understand the local real estate market before making a big investment.

Renting in Spain can be an interesting option for those who need to test the water before taking the plunge. Renting offers enhanced tenant rights but requires more contributions towards repairs. This is still the case following the update to rental laws in Spain published by the Spanish government in late 2023

However, many foreign buyers see renting as wasted money and prefer to buy property abroad. If you know the area well, buying a house in Spain might be better.

Once you know whether renting or buying is the best option, next you will want to consider where you want to live in Spain.

8. Where to buy? The different regions of Spain

Spain offers a huge range of buying opportunities for British and other foreign citizens, with each region offering unique advantages in climate, geography, property types, and prices.

Regions like Costa Blanca, Costa del Sol, and the Canary Islands are popular among expats buying property in Spain. Each region offers unique benefits, from the beaches of the Spanish coast to the vibrant urban life. Understanding the specific characteristics of each area can help in making an informed property purchase.

The Mediterranean Coast, including Costa Blanca and Costa del Sol, is popular among expats buying Spanish property due to its warm climate and accessible beaches. Despite higher property prices, villas and apartments provide good investment options.

The Balearic Islands offer beautiful views in Mallorca and properties in high-demand in Ibiza, while the Canary Islands attract budget-conscious buyers in Gran Canaria with attractively priced property in Lanzarote and diverse landscapes in Tenerife.

A more recent phenomena has seen Northern Europeans who formerly chose to live in the sunnier and hotter south of Spain move north to Galicia - no doubt as a result of climate change and increased heat in more southern latitudes.

Regions like Andalucia or Extremadura offer traditional Spanish culture and lower buying costs. Each area offers unique advantages depending on buyers' needs.

A more recent trend has seen younger families seeking to lay down roots in cities such as Barcelona and Valencia, while existing foreign buyers living in the coastal areas moving north to Galica - perhaps seeking a more temperate climate in a beautiful and green part of Spain.

Ultimately though, as always, beauty is in the eye of the beholder, and it is noticeable that all of our clients are quite certain about the area of Spain they are interested in relocating to.

For more in-depth information, see our guide: Discover the best places to buy in Spain.

9. The Spanish property market and house prices in Spain

The Spanish property market is influenced by various local and national factors. Property prices can vary significantly between regions. Keeping an eye on trends and industry reports is crucial for potential buyers. The impact of economic events, like the global financial crisis, also plays a role in shaping the market.

Rising interest rates globally in 2023, along with an expected credit squeeze, are making buying property more challenging. Data from the Association of Spanish Notaries, shows that increasing interest rates are affecting the rate of increase in Spanish property prices.

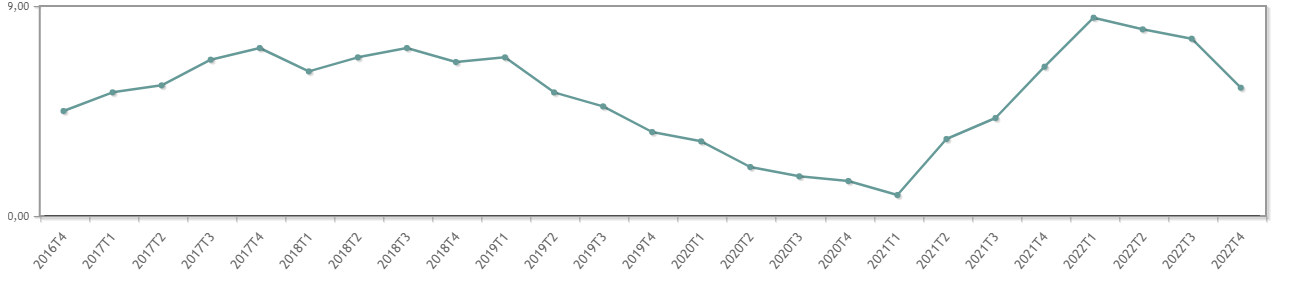

However, the Bank of Spain noted that average mortgage interest rates for terms over three years slightly eased in early 2024, dropping to just below 4%:

Overview of the Property Market in Spain

Recent statistics, published by the Land Registries Association of Spain for Q4 2023 show a nuanced Spanish property market, particularly for foreign buyers. There was a -7.3% change in total transactions and a -13.5% decrease from Q4 2022.

Prices and Regional Variations

Property prices rose slightly by 0.5%, with the highest prices in the Balearic Islands, Madrid, and the Basque Country, and the lowest in Extremadura. Coastal areas, especially Málaga, saw higher transaction volumes and prices due to foreign investment. As can be seen, it is nigh on impossible to refer to average house prices in Spain - there are simply too many variations.

Foreign Buyer Activity

Foreign purchases fell to 15.12% of total transactions. Despite this, British, German, and French nationals remain active in the Spanish property market.

Trends in Property Types

There’s a growing preference for new properties over used ones, indicating a shift towards modern amenities and better investment returns.

Future Outlook

The market is cooling, with reduced transactions potentially leading to price stabilization. However, sustained interest from foreign buyers suggests Spain remains a desirable real estate investment destination.

10. So, is buying a house as an investment in Spain a good idea?

Property prices in Spain vary significantly by location, property age, style, and views. Comparing an inner-city apartment in a rural town with a beachfront property in Marbella illustrates the range.

To understand what you should expect to pay for a property, research current market values in your chosen area. Prices fluctuate, so get up-to-date information before making an offer.

Consider your motivations: Are you investing to rent out the property long-term or as a holiday rental, or are you planning a permanent move to Spain?

If buying a property to rent out, especially to tourists, ensure it has or can obtain a Touristic licence. In Barcelona, for example, moratoriums on new tourist rental licences can impact prices. A buy to let mortgage in Spain might be a good option, and consider overseas landlord tax).

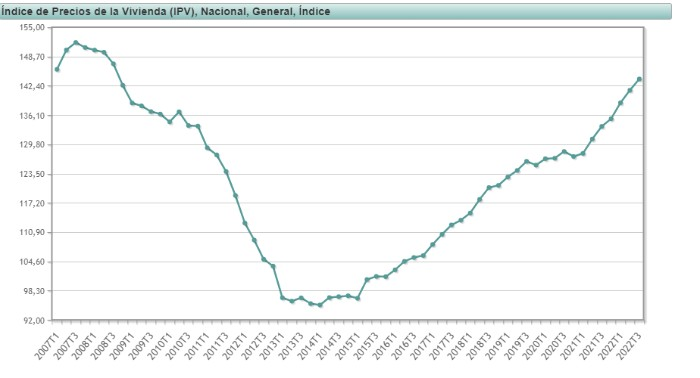

The Spanish National Institute of Statistics (INE) provides a graph showing the evolution of average property prices (in thousands of Euros) from 2007 to Q3 2022.

Property values have nearly recovered to pre-2007/8 financial crisis levels, but regional variations exist, influenced by factors like beach proximity, city centre, and property style and age.

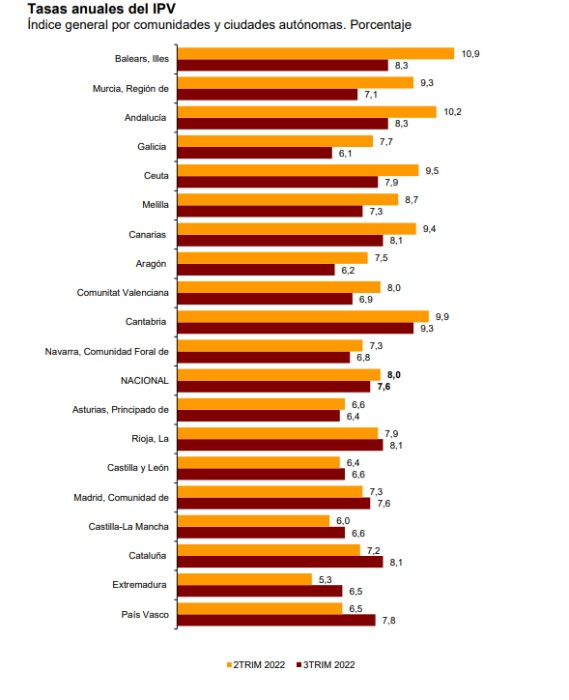

Accordingly, knowing the type and price range of the property you seek is crucial before starting your search. Recent figures show a slowing rate of price increases in most Autonomous Communities, with Q2 2022 seeing slower growth compared to Q3 2021:

With rising interest rates, if you need a mortgage, act quickly to secure a sufficient loan. Cash buyers might prefer to watch market trends over the coming months. Nevertheless, Spain continues to attract global property investors.

That all said, as the figures seem to show, Spain continues to attract property investors from around the world!

11. What about buying an 'off-plan' property?

Buying property off-plan was popular from 2000-2008, allowing for small down payments and potential profits. The 2007-2008 crash halted this trend, but there are still benefits:

-

You get to buy a brand new property, with all modern features

-

You can make payments towards the property in instalments which may be more convenient

-

It may be the only way to buy a property in a sought-after area of Spain

However, risks include potential non-delivery of the property and the builder's bankruptcy. Ensure the builder has appropriate planning permission. Spanish legislation, Law 57/1968, offers protection, allowing buyers to claim funds from banks if the development isn't completed.

Potential Pitfall #1 Flaws in License

- When buying property in Spain, ensure it has the necessary building permits to comply with local regulations. Your lawyer should verify the property's legal status, as some urbanizations have had questionable legality, causing resale problems.

- Additionally, check for unapproved extensions or additions, like swimming pools, which may not appear in the land registry but need verification from the Town Hall Technical Office. Be particularly cautious when purchasing rural properties.

12. Costs of buying property in Spain

The total cost of buying property in Spain includes more than just the purchase price. Buyers should consider property transfer tax, notary costs, and potential estate agent fees. It's also important to account for additional costs such as building insurance policy and registration fees with the land registry.

Costs vary by property type, location, and purchase method, often higher than in the UK. Average costs depend on property value, primarily due to taxes.

Key costs include property tax, which adds significantly to buying expenses. As a result, the Spanish tax office proactively seeks to ensure that declared prices match market value to avoid tax evasion. Be cautious if a vendor suggests declaring a lower price!

Below is a list of the main areas of costs incurred when buying Spanish property:

The Property Valuation Fee

Surveyor fees when buying a house in Spain vary by property price and other factors. The minimum fee is €208, influenced by the surveyor's rates, property location, travel expenses, and technical information needed.

Financial institutions usually accept reports from recommended or independent surveyors like TINSA.

The Association of Professional Property Surveyors suggests €250-€300 for a €120,000 property, with fees increasing based on property value.

Deeds of Purchase - Notary Fees

While legal, private property transfers in Spain are uncommon. Public deeds, necessary for mortgage approval and fraud prevention, involve notary costs. A public notary, an independent official, oversees the transfer process to ensure legality and document verification.

Here are approximate notary fees based on property price:

Property Costs and Notary Costs

| Cost of the Property | Notary Cost |

|---|---|

| €25.000 | €600 |

| €50.000 | €625 |

| €100.000 | €675 |

| €150.000 | €710 |

| €200.000 | €750 |

| €250.000 | €790 |

| €300.000 | €830 |

| €400.000 | €850 |

| €500.000 | €875 |

Inscription on the Land Registry

Once the property has been transferred, it is advisable to register the new ownership details with the public property register. Apart from not being able to obtain a mortgage without doing so, failure to register can cause multiple problems in the future with regard to future property transfers, inheritances, defending title against third parties etc.

If you are buying land in Spain as opposed to simply a house or apartment, there are additional matters you will need to take care of.

Below are approximate costs for having this carried out. It will be necessary to check specific prices with the individual land registry.

Legal Fees

Legal fees for purchasing or selling property in Spain typically average around 1% of the property's value, although this can vary. Higher or lower property values may affect the percentage, but for most average conveyances, the cost remains close to 1%.

Legal fees may increase if the lawyer needs to perform additional work for a mortgage purchase. As with any professional service, verify fees with the individual lawyer, and be prepared to pay more for a lawyer with a particularly strong reputation.

Want to hear what other clients

are saying about us?

Mortgage Fees

If you are purchasing property in Spain with financing, you will of course face a number of costs involved in arranging a mortgage in Spain and include commissions charged by the financial institution involved as well as administrative fees to the government. The mortgage costs can be divided into two types: Finance Check and Opening Charge:

- Finance Check: The mortgage costs associated with checking into the applicant’s financial history to determine if they should qualify to receive the loan is a percentage over the total amount of the mortgage conceded. This is a one-off payment and may only be charged where the mortgage is issued.

- Opening Charge: Likewise there are costs involved in the arrangement of the mortgage. The administration expenses for a mortgage with a value below €150,000 usually include the charge for the finance check.

There also tends to be a charge for carrying out the relevant checks on the property registry so that the bank can ensure that the property that is being offered as security for the mortgage is free of all charges etc. All together, typically the banks will charge around 1% of the amount being lent for arranging the mortgage, and may well insist that you open a bank account with them.

It should be noted that the typical interest rates offered by the banks on Spanish mortgages for non-residents tends to be higher than for residents, supposedly to reflect the customer's higher risk profile. Non-residents will also be offered a lower maximum loan-to-value ratio, so that the maximum mortgage a non-resident can obtain is 70% vs 80% for residents.

It used to be that you could obtain mortgage expenses relief when submitting your annual income tax return in Spain. However, this form of income tax relief was removed some time ago. That said, as a result of the recent increase in interest rates across the world, including Spain, have forced the Spanish government to introduce income tax relief for the hardest hit Spanish taxpayers.

Property Taxes

IVA (Impuesto de Valor Añadido - VAT): Property transfer tax is separated into two parts. A purchase tax is payable on a property purchase in Spain. However, depending on whether the property is new or resale, you will pay VAT or ITP purchase taxes. The purchase of a new property in Spain currently attracts a VAT rate of 10% of the property purchase price.

Taxes: ITP (Impuesto Transmisiones Patrimoniales): The purchase of a resale property in Spain attracts ITP or transfer tax, which varies across Spain but is typically between 7% and 11% of the purchase price.

The reason the ITP rate on a resale property varies is that it is set by the regional rather than central government. So, if buying property in Barcelona, you can expect a ITP of 10% on properties with a value up to €1m and 11% above that. If buying property in Mallorca, however, a graded approach is taken, with an ITP of 8% applicable on properties up to €400k, while properties of over €2m attract a top rate of 13%.

Worth mentioning here is that you can reduce the amount of transfer tax that you pay by buying a house in Tenerife, where the standard rate is 6.5% of the purchase price, regardless of the value of the property.

Stamp Duty: AJD (Impuesto de Actos Jurídicos Documentados): The registering of property deeds upon purchasing a property in Spain as well as the creation of a mortgage in Spain both attract the AJD tax which requires the buyer to pay stamp duty.

These land registry fees are regulated by the local government, and the title deed tax can vary across Spain. Typically, the stamp duty lies between 0.5% -1% of the value of the property on the deeds or the amount of the mortgage.

British buyers should note that while stamp duty is payable in the UK on a property purchase in the UK, this is really the equivalent of the VAT or ITP tax in Spain.

The stamp duty payable in Spain refers to the old-fashioned concept of a duty on the stamping of documents, which is probably where the stamp duty mentioned in the UK originates from, however the two should not be confused. In Spain stamp duty does exist, as well as a transfer tax. However, the latter is the much more expensive of the two.

Capital gains tax in Spain is levied when selling Spanish property. Note that if you are buying a Spanish property from a non-resident seller in Spain, 3% of the purchase monies are paid directly to the Spanish tax agency, in order to cover any capital gains tax liability that the seller may have. This is, of course, deducted from the purchase price.

As a comparison, in the UK, stamp duty land tax is payable when purchasing a property, with different rates applicable depending on whether you’re a first time homebuyer or not. The current rate - at the time of writing - for a single residential property, starts at 2% of the purchase price for properties up to £125,000.

For a full explanation on Spanish tax on property purchases, see: property tax in Spain.

Finally, there is the question of inheritance tax in Spain - something we all naturally tend to avoid thinking about, but it is precisely at the time of buying an asset like a property that we are well advised to take into account the effects of this tax and plan accordingly. Anyone buying a property in Spain should consider drafting Spanish Wills to reduce complexity and costs should it become necessary to transfer the property to beneficiaries.

For an overview of all tax related matters, see our article: tax in Spain.

Home Insurance

Once you have dealt with the transfer tax, stamp duty, legal fees, notary fees and mortgage arrangement costs (if required) you have covered the majority of the expenses related to buying Spanish property. However, it doesn't end there.

Often, the concession of a mortgage by a financial organization will come with a requirement to take out a home insurance policy recommended or managed by the same financial institution.

It is difficult to put an average price on such products as they may vary as to what exactly is covered by the insurance – structure, structure + contents, structure + contents + legal costs etc. The most that can be said is that it may be slightly cheaper than the UK equivalent, but broadly in the same range.

Utility Transfer Fees

In many regions of Spain, it is necessary for there to be a technical inspection of the property when the ownership of the property changes.

This is carried out by the local town hall and is to check that the property is safe to be connected to the mains utility services such as gas, electrical and water supplies.

The local town hall will determine the specific regulations, but often if the property was inspected more than 5 years ago it will be required. The cost will also vary, but you can expect to pay from €250 to €350.

Spanish Property Management Fees

Each Spanish property owner, by virtue of being an owner, and from the moment that, upon acquiring a home or commercial property in the relevant building or urbanisation the owner becomes part of the horizontal property regulations, the obligation to pay the common costs arises, “...it not being the case that failure to make use of any service provides exemption from the corresponding obligation,” (Article 9.2 Ley Propiedad Horizontal)

Therefore, the fact that a particular common service is not used, does not remove the obligation to pay for the supply of the service, for example, the use of a lift.

Accordingly, any individual decision, for example non-use of a Spanish property, does not relieve the owner of the obligation to pay their proportion of the property management fee in full. Likewise, where the service functions poorly, the obligation continues to exist, the correct response being to demand that the service functions as it should.

Also worth noting, when the person selling Spanish property is themselves a non-resident, the purchaser must deposit 3% of the purchase monies directly with the Spanish tax agency.

This requirement is in order to ensure that the non-resident seller complies with any tax obligations they may have, for example, capital gains tax in Spain. However, it is the purchaser who must comply insofar as making the deposit of 3% to the tax agency.

Potential Pitfall: Unexpected Costs

- Be careful as there is a risk of substantial costs beyond the purchase price, including: property taxes, mortgage fees, notary fees, and legal fees.

- Additional costs may arise from communal obligations in urbanizations, where new owners could inherit previous debts or be liable for future upgrades.

- British citizens should also consider visa costs and the benefits of opening a Spanish bank account to avoid delays.

- Lastly, consider future costs such as selling fees and inheritance tax.

13. Financing a Property Purchase

When buying a house in Spain, it is important to be aware of the various requirements and conditions related to mortgages and deposits. Generally speaking, mortgage providers do offer loans to non-residents of Spain up to 70%. This is a lower loan to value mortgage than currently available to Spanish residents who can expect to obtain up to 80% (subject to the profile of the applicant).

This means that buyers will need to have financing (either from savings or other lenders) sufficient to meet these criteria.

In short, non-residents can get a mortgage in Spain but there are certain legal requirements that must be met. The buyer will need to have sufficient funds to cover a deposit (typically) of at least 30% and should also be aware of their rights and duties under Spanish law when it comes to completing or cancelling a purchase.

In Spain, there is a stamp duty payable on mortgage financing. The central government has devolved this matter to the regional governments, but has set a minimum and maximum - anywhere between 0.5% to 1.5%.

Fortunately, a Spanish Supreme Court decision recently ruled that it is the banks that must pay this fee.

There will also be bank charges which generally range between 0.2% to 2%, depending on whether you are making a new purchase or refinancing an existing mortgage.

It is a good idea to reach-out to a specialist mortgage advisor in Spain, since banks can be choosy when offering mortgages to non-residents with no local personal finance history, and tend to charge more. It's advisable to compare offers from different mortgage lenders and international banks to find the best terms.

This is especially the case if planning to invest in a property to rent-out to tourists in Spain. It can be tricky to get a buy to let Spain mortgage, (known as an investment mortgage) and the loan to value ratio can be quite low.

Professional advice is recommended, both in regard to obtaining financing, as well as the legal and tax consequences of renting a property out to tourists in Spain. Working with a reputable mortgage provider and understanding the terms of the mortgage agreement are essential steps in the financing process.

The fees, however, do not end here. You then need to consider Spanish government sales or property transfer tax.

Want to hear what other clients

are saying about us?

14. How much to offer for a Spanish property

When deciding to buy Spanish property, determining the initial offer can be challenging. While in Spain, it's not standard to offer 10% below the asking price as seen in other countries, it's common for the final sales price to be lower than the initial asking price, especially for resale properties. Discounts on new builds are less frequent.

Several factors can justify making a lower offer, such as:

- the age of the property,

- its condition at the time of the sale,

- the area in which it is located,

- the demand in that area and price of similar properties, and, of course,

- the seller's urgency to sell (which we cannot normally know).

15. How to buy Spanish Property: The Process

Once you have identified a property - either privately or with the help of local real estate agents - and an offer has been accepted by the seller, you begin the legal purchase process of acquiring a property in Spain. Below we looks at the most important aspects:

16. Valuation of the Property

For those using a mortgage when buying a property in Spain, it will be necessary to obtain a valuation of the property. Some people who don't need a mortgage also want to obtain a valuation to ensure they are not overpaying (though the estate agent and lawyer will independently be able to provide feedback on this).

The surveyor must be certified by the Ministry of Finance under the Law Regulating the Mortgage Market (Ley 41/2007).

Surveyors or architects may offer various survey types and can assist with planning permission or building permit issues raised by your lawyer.

The minimum charge for a valuation is €208, depending on factors such as:

- Surveyor or company rates

- Property location

- Additional expenses (mileage, etc.)

- Access to technical information (plans, etc.)

Financial institutions must accept the surveyor's report, so you'll likely use one they recommend or an independent surveyor like TINSA, which has connections with most financial institutions. You can also find a list of suitable English-speaking architects in Spain.

17. Buying Property that isn't fully Registered on the Land Registry

Purchasing property in Spain can sometimes reveal that the property is not registered in the Land Registry. How can buyers ensure they acquire good title?

New Build Notice Deed

For new build properties to be added to the registry, the vendor must draft a ‘New Build Notice Deed’ (escritura de declaración de obra nueva) before a Public Notary. To ensure legal protection, buyers should insist the seller reflects the actual property situation in the Land Registry.

When the seller is an individual, it's essential to arrange deeds for the new build to register the title in the Land Registry.

Finalised Project Certificate

The vendor must obtain a ‘Finalised Project’ certificate and visit the Public Notary with municipal licenses to confirm the construction complies with the granted planning permission and local urban planning laws.

In Mallorca and Ibiza, vendors must also provide a ‘habitability certificate’ (cédula de habitabilidad) or ‘first occupation certificate’ (primera ocupación) and the Energy Certificate, per European Union directives.

Additionally, a registered architect must issue a certificate detailing the construction's surface area and other relevant measurements.

Finally, the vendor must declare a price or value for the new build in the property deeds, typically the same as the sales price. Once processed by the Notary, the property deeds can be inscribed at the Land Registry.

Nota Simple

Before signing a private agreement or an option to purchase, the purchaser must ensure the new build is registered at the Land Registry. Failure to do so may result in delays or a failed operation.

By obtaining a ‘basic land certificate’ or ‘nota simple’ from the Land Registry office, the regulatory status of a new build can be verified. Typically, the vendor bears the Notary and Registry costs for filing and registering the new construction. Doing it personally incurs a nominal fee of approximately €10.

Here, our lawyer Jose notes the importance of a visit to the local land registry office in Spain:

Potential Pitfall: Problems with Title

- When buying Spanish property, ensure it is registered in the Land Registry, as unregistered properties - while often put up for sale to unsuspecting foreign buyers - can result in worthless investments.

- Additionally, verify that the details match the Catastro register - a registry managed by the Spanish Tax Agency - to avoid registration issues and potential tax overpayments.

18. What is an NIE number and how do I get one?

Before being able to do, well almost anything in Spain (and certainly to purchase a property) you will need to get a Spanish NIE number - either at the Spanish Consulate in your country of residence or in Spain at a specially designated "Office for Foreigners" (Oficina de Extranjería) or via the National Police.

It typically involves arranging an appointment date at the relevant location, nowadays often over of the form that needs to be presented at a nearby bank to pay the administrative cost and then return to present your identity documents and proof of payment.

Certain regions will require proof of the purpose for obtaining the NIE, such as buying a house in Spain.

An NIE may also be arranged by your legal representative upon completion of a power of attorney or similar document.

19. Banking in Spain

The ever growing population of expats has led to a rising demand for opening a bank account in Spain, especially among foreigners. Many Spanish banks cater specifically to non-residents.

A local bank account simplifies setting up standing orders for utility payments.

However, opening a bank account for non-residents in Spain can be challenging. You typically need to meet one of the following requirements: be a Spanish national, an EU citizen, or have permanent residence in Spain. These criteria determine eligibility for opening an account.

Spanish banks have varying rules for foreigners. Some are stricter, such as requiring UK citizens to provide proof of residence or property purchase.

Expect to pay higher fees than in the UK. Spanish banks generally charge more, and non-residents often face additional premiums.

20. Is it necessary to pay a deposit when buying a house in Spain?

In Spain, it is standard to pay two deposits when purchasing property:

- An initial deposit of €1,000 to €3,000 as a “reservation fee.”

- A second deposit of 10% of the property price.

Initial Deposit

Real estate agents often require an initial deposit to "reserve" the property, claiming it takes the property off the market. However, unless the agent has exclusive rights, this is usually not the case. They may continue marketing and negotiating with other buyers. The real purpose of this deposit is to show that your offer is serious.

Second Deposit and Preliminary Contract

After initial checks confirm the property's condition and eligibility for purchase, a "preliminary" or "deposit" contract is signed. This "contract-to-contract" stipulates that the property will transfer from the seller to the buyer by a specific date. Penalties apply if either party fails to complete the transaction:

- The buyer forfeits the deposit (up to 10% of the property's value).

- The seller must return the deposit and pay a penalty equal to the deposit, effectively returning twice the amount.

Refundable deposits depend on the terms agreed in the arras contract. Ensure you understand your rights before signing any agreements.

Here, Oscar, one of our lawyers in Barcelona discusses in more depth the deposit required when buying a property in Spain:

Potential Pitfall: Construction Errors

- Before buying Spanish property, a survey is essential. Issues like aluminosis, caused by adding aluminum to concrete in the 60s, can make buildings unstable and unhealthy, especially in humid areas.

- Local lawyers and surveyors can identify such problems, explaining why a property might seem like a bargain. Always seek local expert advice before proceeding, particularly if the deal seems too good to be true.

21. Final Step: Inscription of a new title on the land registry

Once the property has been transferred, it's advisable to register the new ownership details with the Spanish land registry.

Importance of Registration

Registering is required for obtaining a mortgage and prevents future issues with property transfers, inheritances, and defending your title against third parties.

Registering the new title with the Spanish land registry is a critical step to finalize the property purchase and secure ownership. For more details, see our article on Spanish Property Laws.

Legal Advice

Securing good legal advice ensures a smooth process and safeguards your property investment. Make sure the lawyer you choose is registered with the local bar association or law society.

Your lawyer will carry out initial due diligence checks to make sure licences, title deeds etc are in place, that there are no outstanding debts associated with the property or indeed the urbanization in which it may be located.

For convenience, refer to our list of Spanish solicitors, which includes contact details and client testimonials of English-speaking solicitors across Spain.

Costs

Below are approximate land registration fees. Check specific prices with the individual registry:

| Cost of the Property | Registry Costs |

|---|---|

| €25 | €295 |

| €50 | €230 |

| €100 | €345 |

| €150 | €370 |

| €200 | €410 |

| €250 | €450 |

| €300 | €490 |

| €400 | €530 |

Potential Pitfall: Registry Issues

- When buying property in Spain, ensure it is registered in the Land Registry, as unregistered properties - while often put up for sale to unsuspecting foreign buyers - can result in worthless investments.

- Additionally, verify that the details match the Catastro register, managed by the Tax Agency, to avoid registration issues and potential tax overpayments.

22. (Don't forget to remove the Previous Mortgage)

While not legally required, it is advisable to remove the previous mortgage from the property register. Even if the mortgage has been paid off by the vendor, the charge remains on the register, and removing it incurs notary and registry charges.

Removal Process

- Obtain a Certificate: Get a certificate from the financial institution that issued the mortgage, confirming it has been discharged.

- Notary Involvement: Present this certificate to the notary, who will draw up a public deed reflecting the discharge.

- Registry Inscription: Submit the deed to the property registry to remove the mortgage charge from the property.

Want to hear what other clients

are saying about us?

23. Frequently Asked Questions

When dealing with our client enquiries about buying Spanish property, similar questions tend to crop-up, and we answer them here:

Can I buy property in Spain as a non-resident?

Yes, non-residents can buy property in Spain, often using their properties as holiday homes and renting them out when not in use. Key points to consider include obtaining an NIE number, which is a fiscal identification number, and paying the IRNR (Impuesto sobre la Renta de No Residentes) tax on property ownership in Spain. If you rent out the property, you must pay tax on the rental income during rental periods and IRNR for periods when the property is not rented. Non-EU citizens pay a higher tax rate (24%) compared to EU non-residents (19%) and cannot deduct expenses.

Is it a good idea to buy property in Spain?

Whether buying property in Spain is a good idea depends on the buyer's expectations and the property being purchased. Property prices in Spain have risen over the last couple of decades, and have only recently returned to the peak prices of the 2008 financial crisis. Spain's unique demand from Europe and around the world makes its property more likely to maintain value.

How much tax do you pay when buying property in Spain?

The biggest tax when buying property in Spain is the ITP transfer tax, ranging from 6.5% in the Canary Islands to 13% for properties over €2 million in the Balearic Islands. New properties attract VAT at 10% in mainland Spain and 7% in the Canary Islands. Other taxes include stamp duty of 0.5%-1.5% on any mortgage financing and Council Tax in Spain (IBI), which varies by locality. Non-residents pay a non-resident tax of 24% (19% for EU citizens) on the property's rateable value each year.

How much tax do you pay on non-resident property in Spain?

Non-resident property owners in Spain pay 24% (19% if an EU citizen) of the property's rateable value. The rateable value is 2% of the 'catastral' value (1.1% if reset in the last 10 years), as determined by the Tax Authorities. If you rent out the property, you must pay income tax on the earnings. Non-EU residents pay 24% and cannot deduct expenses, while EU residents pay 19% and can deduct expenses.

How long can you stay in Spain if you own a property?

Owning property in Spain does not determine your length of stay. With a golden visa (investor visa) from investing at least €500,000 in property, you can live and work in Spain without a minimum stay requirement. EU citizens can live year-round but must register as residents after 3 months. Non-EU citizens can stay for a maximum of 90 days within any 180-day period.

Can a foreigner buy property in Spain?

Anyone can buy property in Spain. However, the maximum time you can spend in Spain depends on your citizenship. EU citizens can live permanently in Spain but must demonstrate financial self-sufficiency and may need medical insurance. Non-EU citizens need a visa, such as a golden visa or a non-lucrative visa, to live permanently. Property taxes also vary based on whether you are an EU resident or not.

Is it necessary to pay a deposit when buying a property in Spain?

It is typical in Spain to pay two deposits when buying property: an initial deposit of €1,000 to €3,000 as a reservation fee and a second deposit of 10% of the property price. The initial deposit is required only if you find the property through an agency, which claims it reserves the property. However, despite this payment, the property is not usually taken off the market.

What are the costs of buying property in Spain?

When buying property in Spain, consider the costs of a lawyer and notary, typically around 1.5% of the property's value. If buying with a mortgage, there will be a mortgage arrangement fee. Estate agent fees might also apply, especially if you found the property through an estate agent or real estate website. While usually paid by the seller, buyers may sometimes be expected to cover these fees. Additionally, if the seller is a non-resident, the buyer must deposit 3% of the purchase price with the Spanish tax agency.

Can British Citizens buy Property in Spain after Brexit?

British citizens can still buy property in Spain after Brexit. One option is the Golden Visa program, which grants a residence permit to those purchasing property valued at €500,000 or more. Additionally, anyone who can deposit approximately €27,000 in a Spanish bank account can obtain a residency visa, though this visa does not permit the holder to work in Spain.